Thank you for your support! Paper copy should be available very soon – we are doing the final layout now.

Category: Uncategorized

Hi Alex…Have loved your book. Still reading it. Like the idea of perfect trade. Question about what happens after what Fed does on Thursday. Scenario A will be that they raise by 25 basis points and then say that they are going to go slow on this. Scenario B will be that they do not raise it but say that they are going to raise it soon. How would the stock market interpret these scenarios? Thanks!

Stay tuned for a blogpost on Wednesday: I will write a pre-fed market review.

Superior Trades Aim for Wider Targets.

This has been a busy month, already!

In my book the “The Next Perfect Trade – the Magic Sword of Necessity”, which is now available on ebookit and amazon, I take the reader step-by-step through the process of selecting trades that are aided by market tailwinds. Broadening your range of success is the focus of my portfolio approach.

Also, I recorded my newest interview with Raoul Pal on RealVisionTV (my first interview is available for free on its site using this link; for the latest one you’ll need to subscribe but I find its content invaluable so please take the step to sign up using promotion code “Alex”). It was an excellent chance to review the concepts I was pondering as I was writing the book over the last year, and apply them to the current turbulent markets.

There is no longer an easy equivalent of the logically irrefutable long dollar/long bond trade of 2014; however, chaos breeds opportunities. What does my current investing strategy dictate?

The approaching Federal Reserve meeting is the most contested one in years. In the past, I worked hard to predict the exact path of the Fed Funds, and I was not bad at it. But nowadays I often feel that there are bigger fish to fry.

Some people think they will tighten several times in a row and some people think they are not tightening in our market lifetime. Let’s accept this uncertainty and try to come with a portfolio which will work regardless.

Long-dated bonds were my beacon through this cycle. Again and again, I have been repeating the mantra:

Another beacon of value in the times of stock market correction, may be cheap, established technology companies that are unburdened with excessive debt and have proven to be able to adjust to the change.

On the other hand, the world of currency trades has shifted from “slam dunks” to merely “good risk-reward propositions”. My significant bets on weaker euro, yen, Swiss Franc, and yuan, after the original surge, have meaningful downside.

Chinese currency devaluation is coming into focus. I am inclined to stay with the trade as I can’t imagine any other way to stem the tide of capital outflows.

I have to face that sitting here today having little conviction about the direction of the stock market or economic growth (both domestic and global). This doesn’t mean I can’t have a position.

In my book and in my recent interview, I explain how I rely on my understanding of causality chains between various asset classes, rather on predicting the market direction.

So don’t get flustered by volatility. Take a deep breath, and instead of aiming for the narrow target of precisely anticipating the price action, look for trades that will succeed even when your views are wrong.

Image: Target »» 0o.o0 «« by Erika

what are some of your favorite books on strategic thinking?

Good question! My book “The Next Perfect Trade: A Magic Sword of Necessity” is released today. http://tinyurl.com/q3sdqpo

Currency regime changes: not the “How”, but the “What”.

Like the old Soviet Regime, certain market regimes seem to be entrenched so thoroughly, that it is impossible to visualize any mechanism, by which they can be dislodged. But the Soviet Union fell and did so in a fashion few could have foreseen.

Until only a few years ago, Japan appeared to be caught in the never-ending purgatory of deflation, sagging growth and capital markets, and meaningless reform promises. In 2012, the current account surplus was not scheduled to elapse for a few more years, and the market flows, according to strategists, continued to support the yen. And then the sudden collapse of DPJ and Abenomics. You know the story.

And you also know the story of the Swiss Franc. First it was immovably pegged at a too weak 1.20 exchange rate to the euro. Then the immovable and indestructible peg suddenly evanesced. The franc briefly rallied above parity, which was way too strong. It appeared that the SNB had no means to control the currency appreciation. Until they did. And guess what? EURCHF drifted to somewhere in between 1.00 and 1.20. Probably where it should have been to begin with.

You probably can see where I am going with that. If general economic principles and historical patterns dictate that something has to happen, it probably will. Even if you see no possible mechanism to drive the transition.

Which, of course, brings us to China. In my post

http://alexgurevich.tumblr.com/post/121445061347/china-you-have-to-know-the-rules-to-play-the

from June 13, 2015,

I reviewed a book by John Mauldin and Worth Wray A Great Leap Forward?

I conceded that both China bulls and bears were making strong points. And with regards to currency I was giving heed to both those who said that a massive devaluation was inevitable and those who pointed out the imminent deval was neither necessary nor in the interest of the government.

There were few precedents to establish how price and credit overextensions unwind in tightly controlled communist/capitalist markets.

Personally though, I leaned to the bearish case for both equities and currency, based on the historical pattern for countries with credit growth excesses. Until proven wrong, I had to assume that the “what” of the equities correction and currency deval, even if I didn’t know the “how”.

And given that I ALWAYS put my money where my mouth is, my strategy did not permit me not to trade accordingly.

It was not cheap and my timing was not perfect. And today it is too early to celebrate victory: all my gains are reversible.

Now what? Do I stick to my guns and expect more of the same?

If you were wondering why I haven’t posted any anything extensive on the RMB devaluation thus far (I suspect you have better things to do than to wonder why I don’t post): I had relatively little to contribute to the discussion. I don’t have a clear idea why they did what they did and what their long-term plan is.

So in the absence of such insights, I have to stick the fundamental principle which drove the China trade, as well as other examples above:

Unsustainable will not be sustained.

If you see a major dislocation what have to bet on it eventually being rectified, even if you fail to understand the mechanism of the shift.

One of the reasons I prefer simple directional trades is because the “what” of the market is often easier to discern than the “how”.

And with the respect to China, if (and that’s a big if) you believe that the major dislocations are still there, it is reasonable to assume that they won’t be fixed by a 5% currency move. And so, regardless of what the authorities may have in mind, the odds are skewed towards further devaluation.

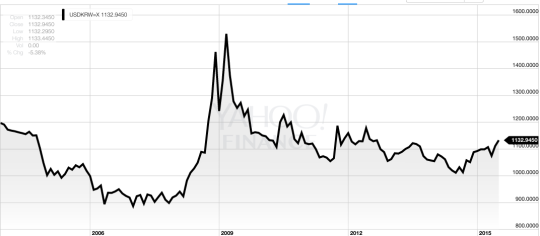

Chart source: Yahoo! Finance

Image: The Unstoppable Wave by Theophilos Papadopoulos

Considering the news that come from China regarding huge capital outflows and shrinking reserves, do you think it might affect your long bond strategy? At some point liquidity issues in the market and the sheer volume of the bonds China is selling can affect yields, especially the long term yields. I see China the biggest danger to the world economy, especially if they decide hard to devalue.

Chinese problems make me more confident of my bullish bond view. A slowdown and especially devaluation are very deflationary for the USA. I am not concerned too much about bond liquidation from China. My sense is that some of it is going on already and is priced into the market. Furthermore, while their portfolio of US securities is very extensive, the duration of that portfolio is not that high. Most of their holdings, to the best of my knowledge, are in the short end.

Alex Japan and Europe are both in the process of QE but USD EUR and USD JPY are going nowhere, so is the QE already baked into the prices? What could be the catalyst for the next leg down and what is the risk that either of them actually rise?

I am not sure if QE can be fully baked in, because the actual buying is a material force that continues to push the currency down. Beginning of a hikng cycle in US could be the catalyst for the next leg down, while a position squeeze reamins the biggest upside risk.

Is the Federal Reserve procrastinating?

The generic assumption is that any government agency is out-of-touch and ineffectual. There may be a truth to that, but it doesn’t mean that the individuals in charge are not actually trying to do their best. Neither should we assume that they are all stupid.

With the next Federal Reserve meeting coming up this week, it is worth reviewing the Central Bank’s dilemma.

Investors can be divided into three main camps:

As I have written before, I have my own small camp: “Economy is fine (at least in the USA) AND deflation pressures are rising”. See my post from March 22nd, 2015 http://alexgurevich.tumblr.com/post/114372436767/orbiting-economic-singularity

It is important to understand that each of those camps has strong arguments and statistics to back their position. Anyone with an open mind should be wary of being completely convinced when so there are so many strong counter-arguments.

As my readers know, I have critiqued Bernanke’s Fed before and I am a bigger fan of Janet Yellen. But whoever the chairperson is, the occusation of being an out-of-touch academic hangs over their head.

Now, as a former academic I can tell you: intelligent people are aware of the differences between models and reality, regardless of their theoretical background. They are aware of the risk of being out-of-touch and are trying with all their not inconsiderable resources not to be.

Now let’s assume that Yellen is familiar with all of the current schools of thought and is not completely convinced by any of them. What is the safest course?

If the Fed followed the hawkish docrine and hiked as early as June, they would have risked the runaway dollar strength and destabilization of global economy, which would eventually backfire domestically.

On the other hand, pushing the hiking cycle indefinitely has its own risks. Arguably, ZIRP can lead to a dangerous rise of leverage and price distortions. In the recent months, as the market had started expecting a more dovish Fed, the long bonds actually collapsed. It is hard to be sure how much of it was just positioning and how much the erosion of the central bank’s credibility, but the consequences could be counterproductive for the economy.

Thus the current procrastinating stance of the Fed:

“We will hike sometime soon, honestly. Just not today.”

One could argue that their information is not likely to become much more conclusive soon. But such indecisiveness may paradoxically be the most benevolent course:

- The pace of the dollar rise stays under control

- Rate expectation are kept away from zero to prevent a complete party in the short-end

So is it possible that the Fed is actually smarter than we think? That they are doing there best to guide their boat between Scylla and Charybdis?

Should we expect more of the same: “just not today?”

Image “Between Scylla and Charybdis” by Cea.

Currency values amidst the commotion

As the Greco-Chinese drama unfolds in its ebbs and flows, strategic clarity is paramount. First, let’s separate opinions from facts.

- It is still completely unknown whether there will be any material economic fallout from the Greece crisis (see my post from June 28th http://alexgurevich.tumblr.com/post/122713740067/greece-and-china-crisis-doesnt-happen-on).

- It is safe to assume that there will be a global deflationary shock wave resulting from Chinese stock market crash and trading freeze-up. Hard to imagine recent events to have no effect on consumption and investment. Recent fall in commodity prices is an example.

In this post I will go over a few world currencies and their connection to the recent events.

USA:

- Facts: US job market appears to be steadily improving. The Fed exited the QE program and is contemplating a timeline for tightening.

- Opinions widely differ and how well the economy is actually doing and whether there is any imminent inflation threat.

- Currency: Long dollar continues to be the theme as it is favored by the policy divergence and spiraling pressure on the Emerging Market and falling commodity prices.

Euroland:

China:

Japan:

- Facts: The inflation target is still not achieved and the economy is still struggling to accelerate. The QE is in progress and current government and central bank are extremely committed to achieving their inflation targets.

- Opinions differ about the country’s economic future.

- Currency: As short-term panic typically cause a flight to JPY as one of the “safe haven” currencies, I see any dips in USDJPY as an opportunity to build long USDJPY position. Indeed, Chinese slowdown is deflationary, and of all the central banks BOJ has the prime political mandate and tools to fight deflation. So the market’s tendency to strengthen the yen during stock market dips is completely counter-economic and a good entry opportunity.

Australia:

Emerging market:

South Korea:

- Facts: Japanese currency weakness and Chinese slowdown are both deflationary for their neighbor.

- Opinions differ of the overall economic health and debt problems.

- Currency: I think KRW is on one-way train and this train is not going North. The current environment seems to offer very low chance of significant KRW appreciation. I am in favor of long USDKRW.

To summarize: long dollar vs. USD, JPY, and KRW seems to be a good risk-reward proposition regardless of the crisis outcome.

Image: “Money changer” by calamur

Chart source: Yahoo! Finance

Alex, just viewed the RealVisionTV interview. When do you anticipate your book will be published?

Thanks for your interest. I have finished the draft a few weeks ago. Editing now. We should know the timeline very soon. Stay tuned.