For a couple of months now I’ve been poking some fun on social media of those who attempted to short Austrian 100-year bonds. The biggest short is, of course, the Austrian government; the hapless issuer is by definition short. Indeed, if you issue bonds at par and they go to 210, you have in effect set taxpayers’ money on fire. Because if you waited and haven’t forgone the opportunity cost, you could’ve raised 2.1 times more money while undertaking the same obligations.

Austria 100yr Bond Price (RAGB 2.1% 9/20/2017)

And now, the United States and Germany are contemplating joining the ultra-longdated bonds club.

There are mistakes and there are mistakes. Sometimes any of us can just be wrong about market direction. We did our homework, analyzed what we could, and made the best educated guess. And then things played out differently due to unaccounted factors, exogenous events, or adverse flows.

And then sometimes we get involved in trades when we don’t properly understand the underlying instrument and the risks involved, ending up with a portfolio not corresponding to our internal positioning logic. Unfortunately, even experienced traders are not completely immune to this second category of errors. But, certainly, such instances raise some red flags.

Only an investor not properly understanding the concept of convexity would think that shorting a 100-year bond at 2% yield is a good risk-reward proposition. I discussed this bond math in a market note several years ago. Indeed, if yields were to go to infinity the bond price can only go to zero, delivering a 100% gain to the speculator, but if yields were to fall to zero (and as we know now zero is not the final bound) their loss is 200%.

Is there no level at which long-dated bonds are a short? I like to think there is a price for everything in financial markets. There is a level to sell super long-dated bonds, but not a level to sell them safely.

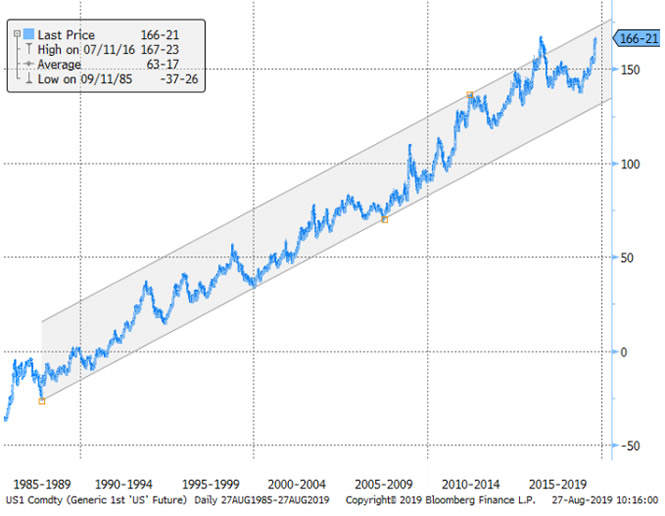

The argument that we should take advantage of historically low interest rates is profoundly fallacious in the presence of multi-decade secular trend as can be seen in the total return of US classic bond futures below. It is the same as to say that my age is historically high, so I can’t get any older.

US Long Bond Futures, Total Return since 1985

One could reasonably argue that the recent rally in the long end is tactically overextended. OK, brave souls, trade this overextension, but it is not the job of the Treasury to engage in short-term speculation.

First time I became involved in the discussion of super long-term bond issuance was when it was floated shortly after the US Election in 2016. In my interview for the Economist, I pointed out that issuing any long-dated bonds, including 30 years, had been a consistent and negligent waste of taxpayers’ money for decades. Were the USA to issue $10bln of 100 year bonds at the end of 2016 they would currently trade at least 120bp lower, costing the US approximately $4billion.

Sure, now is a better time than back then. Just as “then” was a better time than 10 years prior. But hasn’t the Treasury sufficiently banged its head on the wall by issuing 30 years long enough to not be asking for more punishment?

One could argue that interest on Treasuries is not a total waste given that much of it goes to pension funds and other savers. But if we were to follow this logic the objective would be to pay as much interest as possible! No, logically the government should fund itself as cheaply as possible and then decide what to do with the surplus. Especially so in the case of a current account deficit country like the United States, with much of the sovereign debt being held by foreign investors.

So, with respect to ultra-long-term debt, short-sellers, beware. And, issuers, just stop!

Good luck,

Alex Gurevich CIO, HonTe Advisors, LLC