Generally, the process is more slow and complex. I discuss much of it in The Next Perfect Trade. One market modality to consider is: when stocks go down, we can incrementally expect a slower economy and, thus, lower bond yields. Fund managers don’t necessarily rebalance on the daily basis, but fast money speculators create price action.

Month: November 2015

Bitcoin on RealVision

Recent bitcoin volatility has left many people scratching their heads. Is the cryptocurrency heading the way on the new “universal gold” or the way of beanie babies?

As my readers, know I am cautiously curious. Like some, I think it worthwhile to allocate a small portion of your portfolio to the bitcoin, in the event it explodes 1000-fold.

Dan Morehead, a huge bitcoin enthusiast, will not argue it is by any means a safe investment. For myself, I see multiple vulnerabilities:

Government crackdown

Public loss of faith/interest

Competing cryptocurrencies

Encryption-breaking algorithms

But we are not talking about Treasury bonds here, rather it is a “Pascal’s Wager” – modest investment with a potentially infinite payout.

However, the same logic could have been applied to beanie babies.

What distinguishes cryptocurrencies and blockchain technology, so that many experienced financial industry professionals such as Dan Morehead, Ex-Head of Macro Trading at Tiger Management and now CEO of Bitcoin investment firm Pantera, and my former senior colleague, Blythe Masters, throw their lot in with this new wave?

Today in RealVIsionTV, Dan Morehead interviews Wences Casares, the Founder of Xapo and a bitcoin pioneer. This conversation is certain to bring some insights.

Here the teaser https://teaser.realvisiontv.com/146689832

To sign up a free trial for www.realvisiontv.com and view the whole interview, use the code FREETRIAL. If you decide to go on with a paid subscription use ALEX1 for discount.

Good luck in the changing world!

Chart source: coinbase

Is a December Hike Another Step Towards NIRP?

Economic bears welcome the imminent hike with grim glee. Now they can be certain that the Fed will not fail to push the economy into a recession.

Meanwhile, economic bulls and policy hawks point out that signs of reviving wage pressure suggest the Fed is well behind the curve.

The question I ask myself is not “which of those of factions are correct?” but “how should I position my portfolio given the growing dichotomy between the two camps?” If the skeptics of green shoots are correct and we are about to fall into some deflationary hell, I should do very well with my long bonds.

So, for the purpose of challenging my market position, let’s side with employment bulls. What will it take to lose money on being long US bond futures? Not for tomorrow, but on a 2-to-5 year horizon?

Clearly, if the fed hikes once or twice and NEVER goes again, the bonds will be cheap – you can earn 3%yield and fund at 0.50%. The point being that despite a likely volatile market-to-market, over the long-run, the economics has to win – the carry will just accrue. Chapters two and three of my book, The Next Perfect Trade, discuss such carry and value considerations in detail.

Barring US sovereign default concerns, to put pressure on profitability of bonds bought with 3% yield, the overnight rate would have to go above 3% AT SOME POINT. But what else will have to happen in this case?

Along with long US bonds, I am also long the US dollar. I have discussed the interplay between those two trades multiple times. I consider this combination in 2014 to have been one the two greatest macro trades (a “perfect trade”) in all history of markets. But I also wrote in 2015 the position was not looking quite so easy. Indeed, in the months following the completion of the book the strategy has meandered, making a trader rely on tactical skills to deliver any profit.

As of today, the long dollar trade is getting crowded in the anticipation of the policy “lift-off”. So it is not inconceivable that the original hike is already priced in and one or two hikes will not really move the needle.

But what about going all the way to 3% while the other major CBs are still easing? One may argue that hiking cycles in the past have not always coincided with broad dollar strengthening. But in this particular environment, I have trouble imaging the dollar not continuing its uptrend in the event of such a dramatic hiking cycle.

It is important to remember that US is not an export economy and a strong domestic currency may at first be only a very moderate drag on the GDP. Thus a cyclical recession might not be imminent.

However, certain things are likely in a strong dollar environment:

Suppressed commodity prices

- Labor outsourcing

- Emerging markets debt troubles

- Chinese currency decoupling and devaluation

- Deflationary shocks coming from overseas

None of those things make me think of an inflationary spiral.

The historical pattern of the last few decades has been a fairly regular alternation of easing and tightening cycles with each easing cycle pushing rates into a lower and lower territory.

As I have mentioned, I am agnostic about the current strength of the US economy and I am not trying to argue that we are about to enter a recession. But I do assume that a recession will happen sometime in the next few years, and most likely soon after the end on the tightening cycle, as the historical pattern indicates.

In the event of significant rise in interest rates I don’t expect a break in the secular disinflation cycle; in fact, I expect the next easing wave to take us into the negative rates territory (NIRP). Hence, when David Schawel (@DavidSchawel) conducted a poll on the Fed Funds rate three years from now – I called for negative one percent (-1.00%). Not that I have any conviction about this level or timing; I just think it is at least as likely as any other outcome.

So with the Fed getting ready to move, I am getting more constructive again about the long US dollar/long US bonds. I see two longer-term scenarios.

1. One and done. Massive gains on the bonds. Dollar unclear, but still supported by policy divergence.

2. Protracted tightening. Gains on the dollar. Possible pull-back on bonds, mitigated by curve flattening. Eventually, massive gains when the easing cycle plays out.

In the interim, one can expect all sorts of short-term market-to-market volatility, which may be the price to be paid for the high likelihood of longer-term success.

Image: Ruth Hartnup Beware of red men dive bombing off cliffs

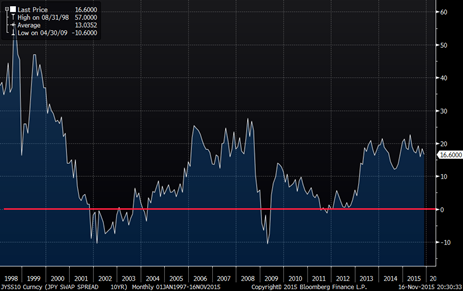

Inverted Swap Spreads – “Not Apples-to-Apples”

Today’s market participants are thoroughly puzzled by the recently

renewed inversion of swap spreads; in

other words, by the fact that the yield on the long-dated US Treasury notes and

bonds is higher than the corresponding interbank swap rate for the same

maturities.

US 10yr Swap Spreads over

past 5yrs

Several portfolio managers, financial journalists and market

spectators are calling this inversion completely

illogical, and even mathematically impossible.

And usually they site this as evidence of a broken financial system.

Indeed, it seems to make little sense that

the swap curve which is based on LIBOR (London Interbank Offered Rate) would

reflect a lower lending rate than the full faith and credit of the US

Government.

From a market perspective, those who follow me know that I am big

fan of US bonds and that I think they are currently cheap on both an absolute

basis as well as relative to swaps. But

in the interest of intellectual honesty, I must concede that the inversion of

swap spreads is NOT mathematically meaningless.

Allow me to share an observation I made in my very early days

after entering the swap market in 1997.

The popular “swap spread” is not a

spread between apples and apples.

In fact, the spread

compares two completely different types of financial instruments.

- A bond, which is an asset, is a security which represents

term lending of cash to the government and includes all associated risks. - A swap, which is a derivative as opposed to an asset,

represents a bet on a string of three- month interbank lending rates which

includes no principal risk.

In other words, the swap spread does not compare ‘term lending

to the government’ with ‘term inter-bank lending’. If you doubt it, see

where a bank can borrow money for ten years – I can assure you the rate would be higher than that of a ten year US Treasury.

So, we are comparing term lending to the government with a

projection of a rolling short-term interbank lending rate. And if the interbank

market breaks down, the payers of Libor will be nailed for a period of days, quarters,

etc, but will not risk the whole principal investment like the bond holders.

Importantly, the way to

think of the inversion of the swap spreads is not a mathematical break-down,

but rather a spike in the term premium. The

situation we are witnessing today is not new to debt-laden, developed

countries, such as Japan.

Japanese 10yr Swap Spreads

Since 1998

That said, we can still perform a “carry” or

“terminal value” analysis of the trade of being long bonds vs. paying

interest rate swaps, similar to the examples I discussed in Chapters Two and

Three in my book The

Next Perfect Trade.

Mathematically, we are comparing three month LIBOR with the

rolling funding rate for Treasuries; the rate at which you can borrow money if

you offer your bonds as collateral. Note: in the unlikely event of imminent

default, the funding rate will go to virtually infinity.

While most of us are not actually afraid of a US default, we

cannot secure the funding rate that would guarantee arbitrage profits.

Banks can likely secure the funding, but they are limited in their ability to

take additional market risk or expand their balance sheets.

In summary, the swap spread inversion is not mathematically

impossible and does not indicate a collapse of the financial system. And, betting on its normalization is a good,

but not riskless trade.

Image: Apples to apples to apples by Artful Magpie