Opinions are divided. Europe and Japan are doing economically better, but their monetary policies will remain super easy which is negative for their currencies. Emerging markets have structural problems. I tend to think that dollar is still mid-trend, regardless of exact path of the interest rates.

Month: April 2015

Twitter Earnings and the Market Philosopher

No one really knows what $TWTR is worth. No wonder, the stock gaps on every quarterly release. This is how it went on 2/6/2015:

But this Bloomberg chart does not reveal the actual volatility that occurred in the first 10 minutes after the afternoon earning announcement. The stock dipped all the way down to the $37 handle, before the disappointment in the user growth gave precedence to the upside earnings surprise.

With no history to “smooth out” quarterly earnings volatility, the investors put a lot of weight on each release.

Twitter bears focus on the slow MAU growth, while the bulls are encouraged by the faster than anticipated monetization, widening advertising platform and the outreach to logged-out users.

I have no qualification to perform a “value” analysis on the stock based on any performance metrics. And my best guess: no one else does.

$TWTR is my philosophical play.

Yes, Twitter is not yet in the realm of numbers. It is in the realm of philosophy.

There are multiple skirmishes happening on the edges of social media domains, such as instant messaging or video streaming. Twitter is losing some battles and winning some others.

Certainly, I prefer $TWTR to win every time, but when it suffers a setback, I am not too concerned. As long as it holds the heartland: the monopoly on being the real time conduit of power and influence.

Twitter is not for everyone, and Twitter is not Facebook. It is designed perfectly for distribution of information, opinions, jokes and fashions from celebrities and thought leaders to people who care about such things.

And that’s the key: Twitter will never get the engagement of Facebook, but it gets the kind of engagement that is shaping our civilization in real time.

I choose to believe that such incessant flow of power can be monetized.

$GOOG, $FB and $TWTR are similar in this way. Like the British Empire they have the privilege of holding their “island monopoly” and fighting wars on other nations’ territories.

Of those three companies, Twitter is most speculative and its future is most uncertain. I happen to think that the upside is large and I like the risk-reward profile, but it is not for everyone.

When the earnings will be released tomorrow afternoon, there likely to be volatility. I would read any numbers with a grain of salt. As I have said, it is too early for numbers. So if I wanted to trade the earnings, I would try to take advantage of the intraday volatility to implement positioning for my long-term views.

This is a principle I try to apply to all markets: “don’t panic after a news release, stick to your program”.

Image: “The Philosopher and the Bird” by Gideon van der Stelt

Treasury Futures Trading Primer

US Government Bonds market has been one of the best games in town over the last couple of years. Especially, if you adjust for the currency. Indeed, though the yields of Japanese and European bonds have declined (priced rose) more than those of Treasuries, the currencies of the respective countries have declined against the dollar. Thus international investors would have done better staying in US Bonds.

When what is supposed to be the safest investment of the world also outperforms most world’s risky markets, it is bound to draw attention from new ranks of investors.

As one of the most vocal “bond and dollar bulls”, I’ve been getting a number of questions regarding the interest rates markets both directly from my friends and via social media.

A long-time friend with a solid academic background asked a particularly interesting set of questions about trading Treasury Futures. In this post I will give our dialog almost verbatim, as I think it might be helpful to some novice traders and even contain some elements useful for more experienced ones. I will also insert some helpful questions and answers from my blog.

To preface the dialog I want to point out a few things.

- Treasury futures might be awkward to trade for small investors as the unit contract has a $100,000 notional.

- The actual mechanics of those futures (with convergence factors and cheapest-to-deliver) is rather complex. This post is not meant to teach this mechanics.

- The advantages of trading Treasury futures are the price transparency and the level field. Through futures we can all enjoy the same economics of funding and carry, as any big bank, without hidden costs.

- Finally, keep in mind, everything below is discussion points and not trade recommendations.

Email I

Could I again ask for your help with (hopefully, rather basic) questions about fixed-income trading? I am learning to trade treasury futures, and my questions are about the underlying math.

Q: The first question is about the cheapest-to-deliver bonds for futures contracts. Am I right in my understanding that, when yields are below 6%, the cheapest-to-deliver bonds are the shortest duration bonds (among those allowed by the contract spec)? For example, the cheapest-to-deliver bonds for the classic T-Bond futures would be 15-year bonds, the cheapest-to-deliver for the 10-Year T-Note futures would be 6.5-year bonds, and so on? If I am actually wrong, how do I figure out the cheapest-to-deliver bonds for each contract?

A: First, I want to be sure you understand modified duration – it appears that you do.

Duration = – d price / d yield

Modified Duration = Duration / Dirty Price

When the prevailing yields are (like now) way below 6%, the cheapest-to-deliver is usually the shortest maturity allowable bond. But what really matters is modified duration, so in rare cases, a slightly longer bond with much higher coupon could have a shorter modified duration and be cheaper to deliver. Current cheapest-to-deliver for every contract can be looked up.

Q: The second question is about durations. How can I figure out the duration for a specific futures contract? For example, would it be right to assume that classic T-Bond futures are roughly equivalent to a 15-year bond with 6% coupon, and thus have duration of about 11 years?

A: In this rate environment the futures contract will essentially trade with cheapest-to-deliver (adjusted by the conversion factor). There will be some small technical factors, like the carry between the spot date and the delivery date, but they are not significant. However, it is incorrect to assume bond futures will always trade like a 15-year bond. In fact, currently they trade more like 20-year bond, because there do not exist any bonds with 15-19 year maturity. Those would have been the 30-year bonds issued during the Clinton era, when the long bonds were temporarily discontinued.

Q: Suppose I expect yields to rise (over the next few weeks or months), and I would like to take a position that bets on the rise of yields. Would it be reasonable to get a spread between 5-year and 10-year T-Note futures, that is, to sell short 10-years and buy an equal amount of 5-years? Are there better ways to bet on the rise of interest rates?

A: Betting on rising yields has been a bad idea over the last 30 years and probably still is. Google “One Chart To Rule Them All” – my twitter post appears on the first page. Check it out.

Typically selling one thing and buying another just increases the amount things that can go wrong, so I almost never recommend such strategy to express a simple directional view. If you have a view on a specific forward portion of the yield curve, this could be a correct trade to express it.

Relative direction of interest rates is rather tricky. If the Fed were to start tightening soon, 5-year futures could go down, while 10-year futures not move at all. You could lose money, despite possibly having a correct view. Of course, the opposite could happen and you could make money on both sides.

Overall I would need to know your reasoning behind the bet to have an opinion whether the strategy is appropriate.

Email II

I have two follow-up questions.

Q: You mentioned that the cheapest-to-deliver for every contract may be looked up. Could you let me know where? Probably a trivial question, but I could not find these data.

A: To look up Cheapest-to-Deliver and risk ratios:

http://www.cmegroup.com/trading/interest-rates/invoice-spread-calculator.html

Q: You indicated that using a spread (buying one thing and selling another) is unnecessarily complex. Is there a simpler/better way to bet on rising yields? (The first thing that comes to mind is simply shorting, say, 10-Years, but I am concerned that doing so would be “swimming against the tide”, since I would be effectively paying the coupon on the shorted bonds.)

[From my blog

Q: When you say Long Bonds will carry if the Fed stays put, could you explain in simple terms what you mean ?

A: By carry I mean the difference between the yield on a bond and the rate at which a leveraged trader can borrow money overnight, using the bond as a collateral. In the current rate environment this borrowing (funding) rate for treasury bonds is virtually zero. If the Fed were to start raising rates, the funding cost would go up, making the carry trade less profitable.]

A: Getting a “free lunch” is not easy. When you do 5/10 spread, it might appear you are avoiding the negative carry, but actually you aren’t. The 5 year forward 5 year rate slides down rapidly as it goes to 4 year forward. The nature of betting against the bond market typically leads to negative carry.

Q: Also, here is an explanation of my reasoning behind my bet on the rising yields. I realize that my reasoning is naive–I am just learning the treasuries–but it may help you understand where my questions are coming from.

I expect that yields will rise at least a little–maybe by something between 0.25 and 0.40–in the next few months, and that, if they fall, they will not fall below the Jan. 30 minimum, and not for long. (From your email, I understood that you feel far less “bullish” about the rates–which is depressing. I really hate when they are that low.)

Given that expectation, I was trying to figure out some position that would allow me to bet on rising yields without “swimming against the tide”, i.e. without simply taking a short position and paying coupon on it.

First, I drastically reduced the duration of my bond portfolio, from about 12 years to about 5. This change was done in my positions in bond mutual funds and actual treasury bonds (not in treasury futures, which I have never traded before). Now, I am trying to to a similar thing with futures, mostly for thepurpose of learning how to use them, with small positions. I first considered doing a spread between Ultra T-Bond and Classic T-Bond, but even a single-contract position turned out too large for me (in terms of potential losses and margin requirements), so instead I am looking at a spread between 10-Year and 5-Year.

A: First – terminology: being bullish on rates means expecting rates to go DOWN (price language as opposed to funding language). So I am actually bullish, but only on the long-dated rates – I have no opinion on the short end.

[ From my blog

Q: Won’t Long Bonds fall if the Fed hikes rates ?

A: Over the last decade we have found out that the Fed cannot reliably control long-term interest rates with their overnight rate policy. In fact, when the Fed tightens, the market starts projecting lower inflation and slower economic growth for years in the future. Thus, long-dated rates often don’t move or move lower early in a hiking cycle.]

If you go deep to the reason why you want to make this bet, you might find ways to do this, without swimming against the tide – this is what Part III of my book is about.

For example,

- If you think the inflation is going to be high, you might want to buy gold.

- If you think the economy is going to do well – you can buy an established stock such as IBM with good dividend, so you will betting on strong economy and earning carry.

Finally, if you already have a preference for higher rates – remember by actually betting on higher rates, you are doubling down.

Image: ‘Fit to Fight: Combatives Course teaches Airmen the basics [Image 2 of 3]’ Photo by Senior Airman Tong Duong via DVIDSHUB

Alex, I am a novice so please excuse these basic questions : 1. Won’t Long Bonds fall if the Fed hikes rates ? 2. When you say Long Bonds will carry if the Fed stays put, could you explain in simple terms what you mean ?

Those are good questions and I think they confused even some professional trader recently.

1. Over the last decade we have found out that the Fed cannot reliably control long-term interest rates with their overnight rate policy. In fact, when the Fed tightens, the market starts projecting lower inflation and slower economic growth for years in the future. Thus, long-dated rates often don’t move or move lower early in the hiking cycle.

2. By carry I mean the difference between the yield on the bond and the rate at which a leveraged trader can borrow money overnight, using the bond as a collateral. In the current rate this borrowing (funding) rate for treasury bonds is virtually zero. If the Fed were to start raising rates, the funding cost would go up, making the carry trade less profitable.

Alex, thank you for writing. Under your “economic singularity” scenario, in which returns to capital must (it seems to me) accelerate to near one while returns to labor decelerate to near zero, there would likely be a fair bit of entropy during the period in which we as a society attempt solve the resource allocation problem presented by those lacking the sunny, ever-compounding capital to sustain themselves. (1/2)

I agree. Economic singularity might lead to some political and societal turmoil, as the world adjusts to the notion of labor irrelevancy. For as long as the process is gradual, we have a chance to reinvent “capitalism” in an non-violent fashion. Beyond that, I can only hope to live long enough to find out.

Hi Alex, congrats for a great blog. I hear from a lot of people that we need to get used to a “new normal” of low interest rates for a long time. But looking at the current debt levels in the developed world and the huge future obligations that countries have with health care and retirements, is it reasonable to expect that all this can be managed without major defaults/reestructurings or inflation? What´s your opinion about this, looking ahead 5 or 10 years?

Some of the developed world countries, such as Japan, have been in a dire debt situation. However, Japan (and later Europe) has embarked on the path of devaluation, which inherently relieves the debt burden.

Given my secular bullish view on the global growth, I see a possibility of the developed world growing out of its debt problems. Some of the emerging market countries, including China, might not be able to do so.

What market and/or economic events would need to occur for you to change your bullish stance on long bonds?

This is an inherently difficult question, since a sequence of events, which would turn around a 30-year secular trend, is not something I am likely to anticipate. So my attitude is to go with the trend I know for now and keep my eyes open.

A few things one might watch:

1. A turnaround in inflation expectations in Euroland and Japan.

2. Substantial reversal of the dollar trend

3. A big rally in gold as a leading inflation indicator

4. Politically engineered wage pressure

May Janet Yellen be the wind in your sails

There are two common delusions about the Fed:

They know something we don’t

They are stupid

Ms. Yellen got her reputation for being a dove in the years following the Great Recession, when it was correct to be a dove. That is not an evidence of her dovishness, but rather of her intelligence.

Nowadays we are at true crossroads. I have discussed in my previous posts, how there is an abundance of solid arguments for both sides of the interest policy debate.

Fixed income analysts, allocators and traders are racking their brains to decipher the central bank rhetoric and the Hodge-podge of confusing data. They are on the sacred quest for the date of the first hike. I can hear them mumbling their prayer: “June, September, September, June, December, no June, no June, maybe September, no September…”

I am no stranger to such soul-searching. My career started with trading interest rate derivatives in the late 90’s. In fact, I used to make markets on basis swaps (the swaps between various floating rates, such as LIBOR, commercial paper, or prime). Such products required me to focus on very short-term rates.

With my recent posts, I weighed into the 2015 rates hike debate. I have been inclined to believe that the Fed was on the course to raise rates this year and the burden of proof was on the doves. But I have never had a date pinned in my mind.

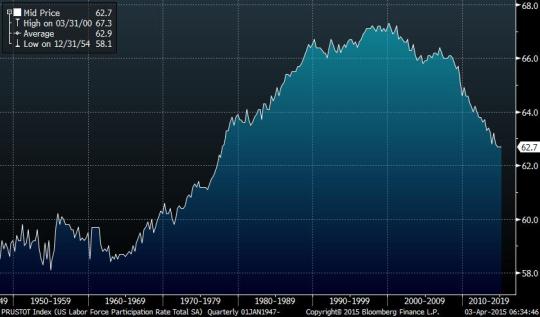

The recent unemployment report, however, was unquestionably weak. On Friday, I was one the people, whose attention was drawn to the continuing downtrend in the participation rate.

It is hard to get too excited about the falling unemployment rate, when the participation rate is only accelerating on its millennium downtrend. There are different ways to interpret this phenomena.

I think that lower participation rate reflects the trend towards labor redundancy, about which I wrote in my recent post on March 22nd. The economy needs less and less human input to march forward, so people are getting pushed out from the labor market.

Those long-term considerations combined with recent headline weakness, could by themselves shake any hawkish conviction. But even before the April 3rd release, the sentiment had been shifting towards greater uncertainty and confusion.

I am throwing in the towel. I don’t know what the Fed will do and Janet Yellen doesn’t know either. What is more important, she is not afraid to say so.

I am not a fan of the Central Bank policy of predictability and gradualism. On occasion, it felt that Greenspan and Bernanke were more compelled to hold hands of Wall Street traders than to protect the actual economy.

Indeed, financial media has a tendency to portray high volatility and low liquidity as a negative course of events. Critiques of the Quantitative Easing, for example, often point out that the program might reduce liquidity in the sovereign bond market. I could never understand it: given the huge budgetary and macroeconomic impact of the QE, are we really so worried about some traders being hurt by the bond volatility?

Many would agree with me that long period of low volatility and apparently unlimited liquidity lead to over-leveraging by risk takers.

In this case, is it not reasonable to deduce that the measured and predictable Fed was among the culprits of the recent financial crisis and the Great Depression?

My recent critique of @benbernanke on Twitter caused a surge of disagreement and debate. The general feeling was that were lucky to have him as a chairman during the crisis. My opinion is that things couldn’t have gone much worse.

Admittedly, I am biased. I got hurt badly in August 2007 by betting on the Fed responding to the freeze-up in financial markets much more vigorously. I couldn’t imagine (and still can’t) that Bernanke’s response to the unfolding catastrophe would be slow slow and lackluster.

Do you see LIBOR going up in August and September? Do you see that the Fed barely managed to get it down by the end of the year?

I see this as egregious a failure, as Greenspan’s infamous 50bps hike in May 2000 in the middle of the unfolding collapse of the internet bubble.

Am I now asking the Fed for a bailout? No, the Central Bank has no obligation to bail out my portfolio. There shouldn’t be too concerned if their actions blow up a few traders and help disproportionately a few others.

But when a systemic crisis unfolds, it is beneficial for the Fed to move with decisiveness of Alexander the Great and not to worry about timely signaling and methodical approach.

This is the problem with academics running the Fed: there are afraid to be wrong and act prematurely, so they collect the preponderance of evidence before acting. Traders have no such compunctions.

You see the financial system freeze? Cut right away, don’t talk, just cut! You find out your actions were excessive: tighten back. Nobody was ever able to explain to me what was wrong with the Fed being dynamic and flexible.

I hope that Ms. Yellen will bring us a more dynamic Fed and a higher interest rate volatility. Instead of the Fed pushing forward on a preset course with bull-headed certainty, I’d rather have a factitious collection of central bankers as confused and befuddled, as the rest of us, by the conflicting stories.

Let’s allow the possibility that the Fed knows about the dollar, the unemployment, the globalization, the U3, the U6, the commodity prices, and even the economic singularity. And they don’t know either what the should do or what they will do.

I don’t claim to be a better economist than Ben Bernanke. In fact, I respect his intelligence and scholarship greatly. Now that he has started blogging, I think he is on a short-list to be the most influential financial blogger in the world.

The same is true about Janet Yellen: I am sure she knows everything I do and more about the economy and inflation.

What I am trying to be, is a better trader. So let’s trade circles around the Central Bank.

With intelligent, but unpredictable Fed, and complex economic story, is it really worth committing our capital to pinpoint the “lift-off” date for the rate cycle?

My strategy over the last couple of years was consistent with remaining agnostic about the first hike. I have summarized it in a tweet last year:

Long bonds are perfect:

- Fed hikes – they rally.

- Fed holds – they carry.

So I will stay the course and keep away from bets on the short end of the yield curve.

I am also staying long dollar, because I think the dollar will benefit whenever the hiking cycle will start, and especially so, if the rates will go up much more than I expect.

This is how I hope to circumvent Yellen’s dilemma and survive whatever course she takes.

dove-object-black2 Image by David Campbell