Short JPY, CNH, and NZD are three currencies positions that have been prone to elicit doubt and second guessing recently.The great JPY short (long USDJPY) initiated as early as 2010 is much discussed in my book. Through 2015 it satisfied many characteristics of a superior trade.

Short CNH (long USDCNH) and NZD were also added to the portfolio in early 2015. Several of my blog posts discuss the favorable risk-reward of those trades, especially USDCNH.

The common theme between these three trades is that all of them were initiated based on very solid strategic considerations and had delivered excellent profitability until recently. Over the past several months, all of them experienced a significant draw-down and/or a pickup in volatility. And all of them had experienced a meaningful challenge to the concept of their individual superiority.

Yet in all three cases, I have chosen to stay with the trades, albeit with differentiated risk exposures. In this piece I will discuss the various considerations that ultimately lead to this decision with regards to JPY.

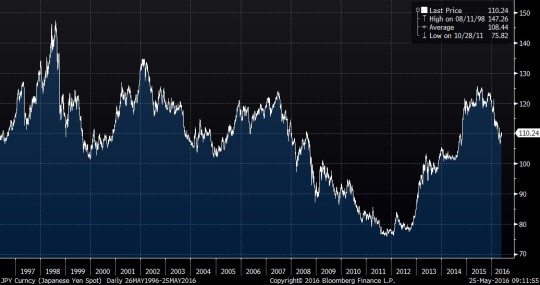

Entering long USDJPY in the low 80’s and pyramiding it as the momentum built, I had established clear price targets; 110 in the event of a stable dollar and 120 to 125 in the event of much broader dollar strength. Price targets are to be respected and I dutifully took profits around the 120 level. In fact, by the end of 2015 my exposure to USDJPY relative to the size of my portfolio was less than 15% of what it was at peak exposure.

Whether it was correct to get flat or to run the residual position to see if the market would overshoot was, without the benefit of hindsight, neither here nor there. The true strategic question was what to do once the significant correction in USDJPY had occurred.

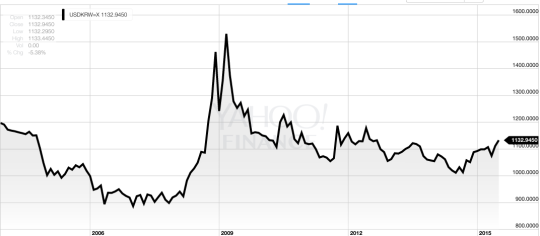

20yr Chart of USDJPY

Based on the chart above, it is not clear whether the cyclical trend is sustained. As for the secular trend, it is more favorable for yen on a price basis and slightly more favorable for the dollar on a total return basis.

With respect to specific asset valuations, Chapter 1 of my book discusses the importance of a currency pendulum, which is propelled by economic gravity. Such gravity is often manifested by a central bank policy.

So is the recent change in USDJPY direction a sign that the pendulum has started to swing back the other way? It is important to remember that CB talk and incremental policy adjustments are more important in terms of changing sentiment than fundamental flows.

Indeed, every speculator encouraged or discouraged by the BOJ, who sells USDJPY, is the speculator who later has to buy USDJPY. And since our time horizon is longer than that of virtually any other market player, the net long-term effect on our portfolio is minimal.

Spec JPY Positioning (CME, Non-Commercial Futures, >0 = Long JPY, Short USDJPY)

However, the actual policy does have an effect. A central bank is a monopolistic issuer of its own fiat currency. And continuous increase of supply is bound to make a product cheaper.

The fact remains that the BOJ is continuing to buy assets and add liquidity and the FED is not. Furthermore, I see no imminent change to this situation.Thus, I find it hard to imagine that economic gravity would change against the dollar, unless the Federal Reserve policy were to change dramatically. Our long bond position should take care of such an eventuality.

For now, I regard the recent yen strength as a correction of a trend over-extension. Staying long USDJPY through such a correction has a logical implication. We are supposed to add to the position if it goes further down.

I try very hard to avoid the fallacy of trying to pick an exact “floor” for the price. If it went down to 108 there was no reason to be sure it couldn’t go to 106 (and it did!). But since our core thesis is based on policy, such price action should encourage us to increase the position rather than stop out.

As one of the superiority tests for this trade, let us check if its opposite is a “self-defeating chicken” (strategic language from Part III of my book). We don’t know whether USDJPY has currently bottomed close to 105 or whether it could go to 103, 101, etc. But what we really care about in terms of portfolio risk management are much more extreme scenarios. For example, can USDJPY trade back to the lows of 2011? I think that is highly unlikely. Further JPY appreciation would elicit such a raging policy response from BOJ that the resulting pendulum forces may propel USDJPY to new highs.

Some may disagree. There is an opinion that BOJ is powerless now to weaken their own currency. As I stated before, I am convinced that a CB can always devalue their fiat, as long as there is political will. People may argue if there is such a will at 110, but I assert that there WOULD BE such a will at 90. Thus as a sign of superiority USDJPY appears to have more upside than downside, as a large move to the downside creates a large opposing force.

Another superiority test is analyzing the historical pattern. What actually happens to USDJPY during US tightening cycles? This test comes back mildly encouraging. While having performed well through the 2004-2006 cycle; USDJPY fell sharply during the tightening of 1999 and started to riseonly at the last stage of the cycle in 2000.

But how can we can we tell, without the benefit of hindsight, where we are in the cycle? My preference is to remain agnostic about timing and to stick with what I know: eventually long USDJPY tends to win through the entire tightening cycle on a total return basis. Not the strongest endorsement, but an endorsement nonetheless.

Lastly, comes the dominance test. Assuming that we like long USDJPY, we must check if there are any trades across asset classes which are strictly dominant; that is, they would perform in every case when USDJPY goes higher and possibly in some other cases?

The most natural candidate for such dominance is Nikkei. Will the Japanese stockmarket go up in every case when JPY weakens? Not entirely certain, but the likelihood is high. Furthermore, Nikkei has recently started to show signs of performing when the yen is merely stable, as opposed to falling. Dominance is not established, but suspected.

Conclusion: Long USDJPY is still an attractive trade with attributes of superiority, but it is at a risk of being dominated. Long Nikkei holds its own attraction to us (see my post from February 10th, 2016) and appears to be incrementally favored by the relationship of concurrent necessity. Hence, USDJPY is a “hold” based on the policy support with modest tactical trading, while long Nikkei is an “accumulate” with an eye towards a significant position for the next great bull market.

Keep your minds open, and good luck!