As the Greco-Chinese drama unfolds in its ebbs and flows, strategic clarity is paramount. First, let’s separate opinions from facts.

- It is still completely unknown whether there will be any material economic fallout from the Greece crisis (see my post from June 28th http://alexgurevich.tumblr.com/post/122713740067/greece-and-china-crisis-doesnt-happen-on).

- It is safe to assume that there will be a global deflationary shock wave resulting from Chinese stock market crash and trading freeze-up. Hard to imagine recent events to have no effect on consumption and investment. Recent fall in commodity prices is an example.

In this post I will go over a few world currencies and their connection to the recent events.

USA:

- Facts: US job market appears to be steadily improving. The Fed exited the QE program and is contemplating a timeline for tightening.

- Opinions widely differ and how well the economy is actually doing and whether there is any imminent inflation threat.

- Currency: Long dollar continues to be the theme as it is favored by the policy divergence and spiraling pressure on the Emerging Market and falling commodity prices.

Euroland:

China:

Japan:

- Facts: The inflation target is still not achieved and the economy is still struggling to accelerate. The QE is in progress and current government and central bank are extremely committed to achieving their inflation targets.

- Opinions differ about the country’s economic future.

- Currency: As short-term panic typically cause a flight to JPY as one of the “safe haven” currencies, I see any dips in USDJPY as an opportunity to build long USDJPY position. Indeed, Chinese slowdown is deflationary, and of all the central banks BOJ has the prime political mandate and tools to fight deflation. So the market’s tendency to strengthen the yen during stock market dips is completely counter-economic and a good entry opportunity.

Australia:

Emerging market:

South Korea:

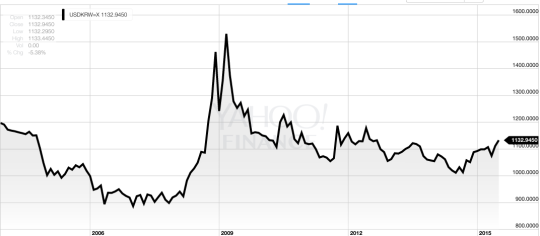

- Facts: Japanese currency weakness and Chinese slowdown are both deflationary for their neighbor.

- Opinions differ of the overall economic health and debt problems.

- Currency: I think KRW is on one-way train and this train is not going North. The current environment seems to offer very low chance of significant KRW appreciation. I am in favor of long USDKRW.

To summarize: long dollar vs. USD, JPY, and KRW seems to be a good risk-reward proposition regardless of the crisis outcome.

Image: “Money changer” by calamur

Chart source: Yahoo! Finance