How did gold become gold? And, more importantly, why is gold staying gold?

Silver had its run during some periods and in some cultures, but silver has become “tarnished” as a store of value.

Gold meanwhile has survived the rise of fiat and major economies moving away from the gold standard. It has also survived the loss of its utility as a convenient medium of exchange.

Certainly, gold has demand from the jewelry industry and some industrial utility. But this “natural” demand is not even a close match for the existing above-ground supply. Imagine what would happen to the price of gold if all the metal in the vaults (owned by central banks or other hoarders) were to be sold.

And yet the value holds. Significant fluctuations for sure, but in the long run, it remains stable.

I am not an expert on the history of gold. To the best of my understanding, precious metals were chosen as a medium of exchange because they do not oxidize easily and remain in an uncorrupted form. They can also be traded purely by weight and are preferable to gems, which have value heavily dependent on their shape and quality.

Amidst precious metals, however, gold is neither the rarest (platinum and palladium are harder to come by) nor quite common, like silver. Gold has solid but by no means exclusive, industrial or jewelry related demand.

My guess is that over many centuries, the precious metal has hit it’s “golden” mean; it is common enough to be a worldwide currency, but not so common that mining can disrupt its price. It is useful and decorative enough to support some underlying value, but the supply is not so tight that marginal swings in demand would create wild price fluctuations.

My assumption is that through those subtle advantages, gold has simply outlasted its competition. And, as a result, it has gained so much credibility over millennia that its value can no longer be diluted or displaced. Today, gold (XAU = $1,275) is more expensive than platinum (XPT = $915) which is much scarcer and as useful in an industrial sense.

That said, you may have guessed by the title that this post is really not about gold, but about digital assets. Until recently, I was thinking of the dichotomy between the precedence of bitcoin and the advantages of alternative protocols. I am realizing that this dichotomy may be false.

If a universal digital store of value (“digital gold”) is to be established, it doesn’t by any means have to be, and not even likely to be, the universal medium of transactions; a fortiori, it is not likely to be a universal conduit for transactions.

Bitcoin is battling to become digital gold, while ether, for example, is elbowing to become digital copper. If the analogy holds, the price of ether will be driven by technology demand, while the price of bitcoin by the need to store liquidity. Will bitcoin cash be digital silver?

As a corollary, the rise of altcoins geared towards specific purposes is not at all dilutive, but actually supportive of bitcoin. While diminishing its share of trading volume in actual transaction flows, it shields bitcoin from being demand driven and makes it a more attractive store of value.

Now, to assess the future value of bitcoin we need to answer three questions:

I. Is there a need for digital gold?

II. Is bitcoin more like gold or more like fiat?

III. Why bitcoin specifically?

I am not going to spend time on question one; I assume that my readers appreciate the advantage of having digital value storage and I have nothing to add to the already existing discussion.

Regarding, question two, we need to address the issues of altcoins and forks. I have already explained why I think altcoins are no more dilutive to digital gold than platinum or palladium are dilutive to physical gold. And if physical mining for gold is alive and well, so will be the digital mining for digital gold.

Forks are a trickier issue because they cause many to liken a crypto-asset to fiat, and the community of miners to central bankers. So, are forks inflationary (and for the purposes of this post I use the example of recent bitcoin hard fork)?

One definition of inflation is “the tax on capital”. It describes what happens to the purchasing power of your asset if it just sits there doing nothing. Therein lies the distinction between bankers printing more money and the blockchain forking. New fiat does not go proportionately to the holders of existing money; rather it goes where the government directs it (some cynics seem to think it tends to end directed to the richest of us) via specific asset purchases such as QE or via targeted fiscal stimulus such as tax cuts or increased spending. While those things are happening, your savings may indeed be eroded.

But the hard fork gave each current holder an extra asset. Theoretically, it is a zero-sum game, but like just like stocks tend to react positively to a stock split, this particular fork went well for the asset owners. For what it’s worth, I think the fork was more like a dividend than like split, but this is not the most relevant debate here.

I think it is obvious that forks do not TAX the capital of current holders. A more interesting question, however, is posed by forward contracts. If I promised you delivery of a bitcoin on July 1st, 2017 or September 1st, 2017 this contract may have had a different value depending on how it was written. Forward stock value, for example, dips down on the ex-dividend date. From my perspective, therefore, it is not so much an issue of forks being inflationary, but the necessity to program blockchain contracts carefully.

If the government one day announced that every dollar is to be exchanged overnight into ten dollars it would not be inflationary in itself because the purchasing power of existing money wouldn’t change. But it would be important to know what happens to existing contracts and liabilities. If you have a salary or pension guarantee, does it go up 10 times? What about debt payments? If it is all done proportionately, there is no economic impact. But if it’s done selectively a wealth redistribution could happen.

Lastly, why bitcoin specifically? It has been discussed ad nauseam why bitcoin mining qualities and limited supply gives it aspects similar to gold. But its unique advantage with respect to other crypto-assets is that was there first. And now it is in the process of outlasting the competition.

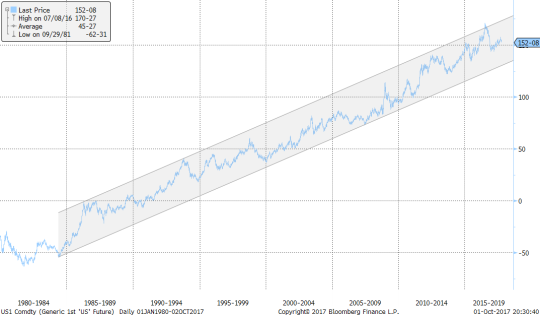

When bitcoin first started trading, I was mostly unaware and fairly agnostic of its value. As a trader, I became interested in its vertical rise in 2013 which was followed by a bear market in 2014. Notably, its drop found support; it didn’t continue to fall to permanent obscurity below the event horizon. Instead, it stabilized, put a solid double-bottom in 2015, and started to creep up.

XBT, Oct 2012-Oct 2016

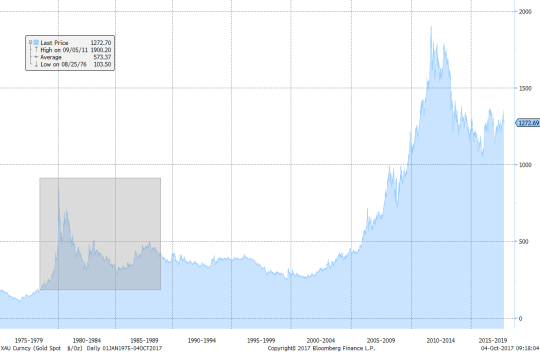

This trading pattern is consistent with precious metal behavior, only compressed to a shorter horizon. For example, look at the slow consolidation in gold after the spike of 1980.

XAU, 1975 – Present

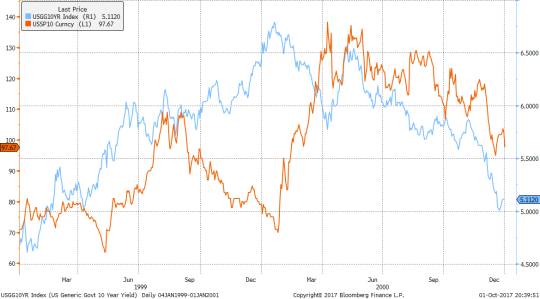

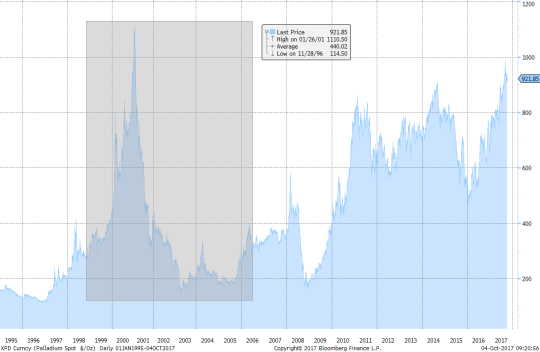

Or, more recently palladium after the spike of 2001.

XPD, 1995 – Present

Given the historical trading pattern in precious metals, the buy of bitcoin in 2015 was relatively easy. But now, at 20X (including fork) the early prices, it is a more complicated trading dilemma. Bitcoin may or may not be a “bubble”, but it is important to remember that it did have a major “burst” in 2014 and, even this year, the market has witnessed bitcoin endure two meaningful corrections.

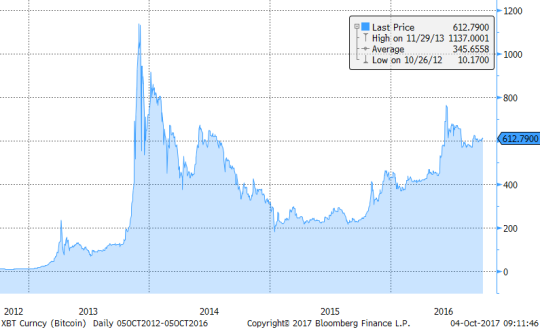

XBT, 2017 (Actual price swings were even wider than BBG-sourced data below)

And every time it survives and stabilizes, it gets extra “gold cred”.

In summary, despite the rise and fall of various alt coins and fork considerations, “time” works FOR bitcoin, not AGAINST it. Every day it doesn’t disappear, it gets one step closer to a permanent status of digital gold.

Good luck!