Before August of this year, the answer was a no-brainer. Remember, our imperative is to buy low. I have written multiple times about the Chinese currency both before and after the August 11th devaluation.

My position had been clear – given the vol market’s extremely low probability on a devaluation, “Short RMB” was a mandatory, superior risk/reward bet, but not the kind of trade on which you would want to blow all of your capital. There was no ex-ante certainty of timing or magnitude.

Now that the second wave of the move is in progress, what am I doing? In markets like USDCNH, with expensive bid-offers, there is extra value in not “fidgeting” and just running my positions. So I am sticking with my options, which are now deep-in-the-money and are essentially outright positions.

But that has been the case for a few months. Am I going to adjust my positions? My book The Next Perfect Trade discusses the currency pendulums in the first chapter. Normally, once a major trend has launched I would be piling in, as if possessed by macro demons, and not worrying at all about not getting the “cheapest level”.

I am, however, holding steady (while very substantial) positions, because long USDCNH is no longer a clearly “superior” trade according to my strategic language.

I still think it is a positive expectation trade: the devaluation is more likely to be equal or greater than projected by the market. But the question I am asking is, “are there more dominant trades out there?”

Let us disregard the scenario of re-appreciation of RMB as unlikely, and break down the market analysis into two scenarios for the next couple years:

- Relatively stable or slowly depreciating RMB

- Massive depreciation either because of the government’s loss of control or a radical policy decision

While long USDCNH looks good in light of Chapter 1 of my book (entitled “Trend”), it has problems with Chapter 2 (“Carry”). A slow depreciation may or may not catch up to the 3.4% devaluation priced in the 1yr forward. Many of us would agree that if Scenario 1 is a given, then the trade looks mediocre.

Scenario 2 is obviously great, but I seek trades that work in the broadest range of economic outcomes. In other words, are there trades that are as good in Scenario 1, but also hold up in Scenario 2?

I have two examples:

- Long US bonds, a trade which I like for reasons I’ve written about ad nauseam; and

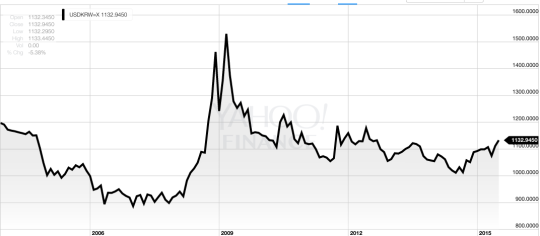

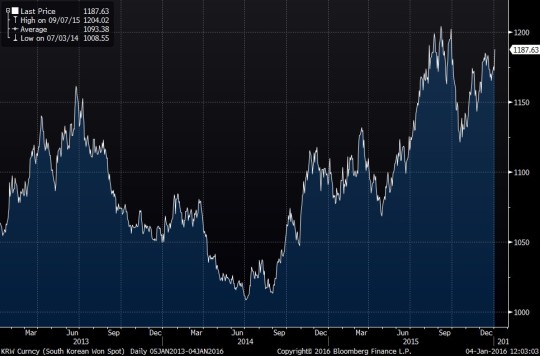

- Long USDKRW, which while not clearly dominant, offers a nice diversification.

With positive carry in the bonds’ case and low carry in KRW case, we don’t have to worry about the velocity of RMB devaluation. Both trades are likely to get a tailwind from a lower Yuan, regardless of timing. And both trades have the potential to work even with stable RMB.

One caveat with KRW and has move quite a bit already, while not having the same overwhelming secular trend and superior risk profile as the bonds.

But both trades are set to do extremely well in Scenario 2, a catastrophic devaluation.

To summarize: While I like and will keep the USDCNH trade, I see a lack of clear dominance and am concerned over awkward liquidity. I prefer to focus my risk on long US bond futures and consider diversifying into USDKRW.

Good luck.