I actually the performance of risk assets has been mixed, exemplified by weakness of EM currencies. It is not uncommon for strong domestic currency to attract capital inflows and support domestic assets. If China were to go in recession. it could definitely test the current world order.

Month: May 2015

Rising stocks and rising rates

Diversified portfolios perform well during a hiking cycle – a simple and undeniable observation in a recent Fortune article by Joshua Brown @reformedbroker.

http://fortune.com/2015/05/26/investing-rising-interest-rates/

The points made in this post elicit my response, as they touch upon the core of my own strategy. I offer not a rebuttal, but rather a discussion of nuance on some of those points.

Point 1. Success of diversified portfolios during tightening cycles over the last forty years. I believe this is mostly a function of the overall secular bull market in stocks AND bonds. Given the short-term negative correlation between equities and fixed income, the diversified portfolio of stock and bonds has been performing extremely well in the idiosyncratic environment of the last few decades.

Point 2. Bonds don’t do too badly during a hiking cycle. Very true. I have observed this historical pattern and it has been at the heart of my bond bullish strategy over the last two years. The fact is, bond investors are usually well compensated for the anticipation of tightening and major surprises tend to arrive on the side of lower rates.

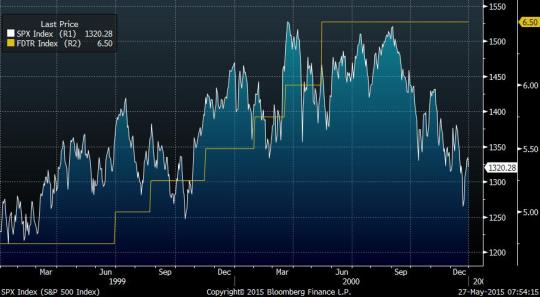

Point 3. Stocks do well during a hiking cycle. Can we agree with that? Here is how S&P500 performed relative to the Fed Funds target during the last two tightening cycles.

As you can see, in both cases the stock market rally continued throughout the cycle and, in one case, even beyond the end of tightening. Both of those rallies, incidentally, were followed by major bear market.

I don’t argue agianst the statement “stocks tend to go up, as the Fed hikes”, but I wouldn’t translate it into the statement “the Fed is about to hike, thus it is good to own stocks”. This would be confusing concurrency with causality. Indeed, the correct causality statement would be “absent a major inflation threat, the Fed continues hiking only for as long as stocks go up”.

Hence, if we have a GIVEN knowledge that the hiking cycle will go on and on, it is reasonable to assume that stocks will be performing. But with this knowledge we can do many other trades, such as short eurodollar futures or five-year notes, or long the dollar.

As we don’t know when the hiking cycle will end, we also don’t know when the bull market in stocks will turn.

Interestingly, this observation doesn’t undermine the credentials of a diversified portfolio. Indeed, this is exactly how it works: the end of hiking and the bond rally cushion us against a possible stock setback, when the economy turns.

Image by Skarphéðinn Þráinsson

How do you feel about treasury notes in the short to intermediate term? I can’t help but feel that the rally will resume soon given recent economic data and collateral shortages across the pond. I also believe that any significant rally across the pond may lead to massive short covering. I’d like to hear your thoughts on the matter. And thanks so much for your insightful blog posts.

I don’t have a sense that people were speculating on rising rates in Europe. Rather, they were going long and got wiped out lately. My guess is the positions are pretty clean in Europe. But I do think that the reality of QE will cause bunds to resume their drift higher.

I have no position on short-term USTs; there is significant risk on both sides. My bullish call pertains only to the long end.

Boston Bob takes bitcoins to Vegas

I have an imaginary friend, whose name is Boston Bob. He is a successful periodontist and an avid poker player.

Some things you need to know about him: his name is actually Juan Carlos, and he has been living in San Antonio all his life. Once he boasted to his poker buddies from the Wednesday game that he had travelled to New England exactly four times. Each time it had been Foxwoods Casino, Connecticut.

So they nicknamed him, you know, Boston Bob.

In his younger days he took road trips to Dallas, and even all the way to Vegas, to play poker. Over the last quarter of the century, he prefers to fly.

In the glorious 90’s, the World Series of Poker (WSOP) was hosted in a dinky, but legend-shrouded, Binion’s Casino, located in the equally dinky Downtown Vegas.

Boston Bob used to buy a one-way ticket and gird himself with a hidden pouch loaded with several neat $5,000 bundles. He didn’t like running out of cash in Vegas. And he didn’t know when exactly he would be heading back. His receptionist was ready to reshuffle his patients’ appointments, if the doctor was doing too well in a poker tournament.

After 9/11, Bob’s Vegas routine was shattered. The combination of his New England brown skin and the unfortunate fact that his driver’s license said “Juan Carlos”, in the eyes of TSA made him… I don’t know what. And the one-way tickets didn’t help.

So no more cash between his belly button and belt buckle. He started wiring money into casino accounts. The bank charged him, like, twenty-five bucks per wire and he could live with that.

But that soon proved to be a hustle. The WSOP was now hosted by Rio, a semi-dinky Off-The-Strip casino. I happen to like Rio, but my friend Bob prefers to stay in Bellagio, where the fountains spray high, the lights are shiny, and the side games juicy. He is not averse to visiting the poker room at Wynn Casino either.

Now having money on account with one casino is little help when he needs money at another. And withdrawing and converting chips took time and creates way too many tax records.

I’ll pause here to reassure you that Boston Bob is a US Citizen and a law-abiding citizen at that. He reports his poker winnings as meticulously as his business earnings. But he doesn’t like audits. Who does? And multiple wires and cash transfers don’t help poker-playing Juan Carloses of this world to fly under the radar.

So what does my friend need? He needs a simple, safe and easy way to carry liquidity with him on his casino trips.

I sense the excitement rising among the Silicon Valley crypto-geeks, who are all, no doubt, reading this story. Boston Bob needs a bitcoin wallet! A tiny chip fitting in a pendant around his neck, preloaded with ready-to-use bitcoins. If the casinos were to honor them – he could jump around Vegas unencumbered by cash transactions.

But, wait a second! Boston Bob is a periodontist, not a bitcoin speculator. He has seen the coin jump up and down 20% within days. He likes to be well funded for a trip, but usually uses only a fraction of his stash. Is he supposed to buy $50,000 in bitcoins, only to find them worth $40,000 when he comes back after breaking even from poker?

What my friend needs is not to buy bitcoins, but to borrow them!

Remember, he is a doctor living in a cheap city. He has cash in his account and he is happy to pledge it. What’s more, the blockchain will not let him welch, will it now? After the trip, he’ll return the unused bitcoins without taking much exchange risk.

There are two points to this story:

- Casino industry may benefit from incorporating bitcoins into its operation

- There is a market for bitcoin borrowing by people who need the “just in case” liquidity as they travel

And if we can lend bitcoins to Boston Bob, we can lend it to others!

For as long as bitcoins prices don’t go to astronomical levels, the supply is mathematically limited, and more and more crypto-enthusiasts store their currency in digital vaults, there is bound to be a shortage of supply to accommodate the potential transactional flow.

The lending/repo market will allow businesses and individuals to use bitcoins without taking exchange risk, and it will allow the long-term crypto-investors to receive a yield, instead of paying storage costs.

Then we can speak of dollar/bitcoin cross-currency basis swap, bitcoin forwards market, or (if you prefer commodity-speak) bitcoin backwardation.

When we have a deliverable forwards market, bitcoins miners can hedge their future output and have a stable business model.

When we have a non-deliverable forwards market, hedge funds will be able to play with bitcoin derivatives. Don’t you want to see who will go bust first by being SHORT?

Now many, if not most, still think the bitcoins are destined to go the way of beanie babies. It is valid possibility, but I see two others to be likely if the bitcoin usage will expand:

- The price will rally explosively

- A liquid lending market will develop, and bitcoins will grind up with positive carry.

Now Boston Bob is asking you the BIg Question:

Who will start the lending business? Or is it there already?

Image by larrykang

Hi Alex, I thought your “Eurozone: economy bull, currency bear.” post was very insightful. There is one sentence I didn’t understand though: “Economic growth increases the supply of domestic currency”. I thought the money supply was used to effect growth, I didn’t know it worked the other way round. Can you explain or direct me to the right material to understand this? Hope its not too dumb a question.

Lending is one of the premium ways of expansion of money supply. If you start a business or a construction project, you take out a loan in the bank, which in fact increases the amount of money in the economy (you use this money to pay your employees, subcontractors and so on). The process works two-ways: lower rates encourage lending and business activity, but positive business outlook encourages lending in its own right.

William Faulkner’s advice to traders: “Kill your darlings!”

A story sometimes needs to be edited down, and so does a trade. Indeed, if you don’t have portfolio discipline, sooner or later you will have no portfolio.

Whatever form of risk management you use for individual trades, there are times when your risk, as a whole, needs to be trimmed.

When this dreaded moment of a severe drawdown comes, it is easy to fall prey to the delusion of “simplifying” your portfolio.

If you are running a diversified strategy, even at the worst moment, you probably have trades on, which are not doing so badly. So the temptation is to first cut the “winners” and keep the trades which are deep under water. The trades causing you the greatest losses at the moment are bound to look most attractive.

“I liked this stock at $80, I must love it at $60, right?”

I had a painful drawdown over the last few weeks. My long dollar and long bonds strategy came under a lot of pressure. While my positions had been sized to withstand this type of correction, I still had to put myself on “orange alert”.

The morning of April 29th, before the FOMC meeting release, I overviewed my positions to decide how I would reduce risk, if I ended up having no choice.

My biggest short against the dollar was the euro, but I was also short other currencies, including NZD. My conviction stayed with EURUSD, as I wrote in my recent post (May 3rd).

Most currencies had moved against the dollar, but by April 29th, NZD had just stalled. My temptation was to cut NZD first: the negative carry was undercutting my certainty, and at the moment EURUSD was getting juicier.

What would have happened if I had followed through on that instinct? On paper my total risk would have gone down for sure. But while in the following two days my portfolio was still drawing down, EUR and NZD went in the opposite directions. I would, in fact, be losing more money without NZD. The “risk-reduction” would have been self-defeating.

William Faulkner had famously admonished us against self-indulgence:

“In writing, you must kill all your darlings.”

If you decide to reduce market risk, you must cut the positions you love most. Don’t delude yourself by taking off winners, and holding on to cherished losers.

Indeed, if your portfolio is under pressure, what should you be worried about most? The worst case scenario is that things will continue the way they are going now and your losers will continue losing, while your winners may continue winning.

Reduce risk to protect yourself against the worst-case scenario or don’t reduce it at all.

Image by Dr. John B. Padgett

Alex, as you so accurately “warned” back in March that “I suspect that market participants, including myself, are not prepared for a dramatic change of rate sentiment in Europe. ” Here we are just two months post your tumblr post, do you believe there is a “marked” change in the “global carry/liquidity” apparatus b/c in a world of “investible” negative yield sovereigns, a bund bleed-off “should” induce a Treasury bounce. Alas we aren’t seeing that and quite the opposite. Thanks.

I think over the last two weeks, we have seen markets moving in the “direction of pain”. For over a year “long dollar/long bonds” trade ruled supreme. I think those who fought against it were forced to give up early in 2015 and many doubters at last jumped on the trend. I don’t see any major new economic challenges to the thesis, but the positioning, as I feared, has become vulnerable.

I still think continuing QE will cap European yields in the long run and provide support for USTs as well. But short-term price action is very uncertain.

Eurozone: economy bull, currency bear.

When the euro was going down in a straight line, it was easy for currency bears to call for the exchange rate with the dollar as low as 0.80. Now when, after a year of beating, EURUSD at last had a good month, the bearish convictions are being put to the test.

Some believe the economic data is beginning to support the reversal. Indeed, the US releases have been mixed at best lately. The debate is raging, how much the recent weak GDP and employment reports were induced by the unusual weather. But the doubt remains.

On the other hand, there are signs that the European QE is getting traction. The economy is picking up, the fears over the Greek exit are being assuaged, the stock markets are setting records, and the bund yields are rising.

I am not denying the possibility that the relative economic performance of the Eurozone is improving. In fact, I have been bullish on European equities for quite a while. The experience of the QE impact on the stock markets both in the USA and in Japan is very convincing.

But does better economy mean a stronger currency? Counterintuitively, this is not automatically so. Indeed, if a stronger economy causes the Central Bank to raise rates in order prevent overheating, it is reasonable to expect the domestic currency to strengthen.

In fact, we’ve to grown to associate inflation fears with stronger currency, as we are so certain that the central bank would step in with tighter policy.

But what if a central bank is locked in its course?

The Fed has now been following an almost two-year program of tapering/waiting/tightening with very little deviation from the original timeline.

Meanwhile, the ECB had committed to Draghi’s “whatever it takes” and has just embarked on the QE path. It is hard to imagine them changing policy based solely on leading economic indicators, without reaching their formal inflation target.

Paradoxically, assuming that the path of monetary policy is fixed, the pace of growth may be counterindicative to the currency strength. Economic growth increases the supply of domestic currency and stimulates imports. All else being equal, it would lead to the currency decline.

Consider the extreme case: if a central bank maintains a super-easy policy and ignores inflationary overheating, a fiat collapse will be eventually inevitable.

Hence, my view:

- Despite the mixed data, the Fed policy is set to be prudent relative to the growth, supporting the dollar.

- Despite stronger Eurozone performance, the ECB policy is set to be super-easy, continuing to debase the euro.

I am sticking with my short EURUSD position.

Image: “Janus” by Códice Tuna

Chart sourced from Yahoo! Finance