Over four years ago, I wrote a post, “specter of negative rates is haunting global bond math,” in which I outlined why negative bonds were more feasible than the consensus believed at that time. Back then, I also started to joke about valuations on the perpetually negative yield curve: “What is the value of a zero coupon perpetuity?”

Not so funny anymore. The amount of negatively yielding global debt peaked out temporarily in 2016 and diminished post-Brexit, but now in 2019 stands at new highs and most developed market (“DM”) central banks (“CBs”) are poised to cut rates — even those already with negative rates, such as the ECB and BOJ. The debate on how to implement deeply negative rates and avoid cash hoarding is heating up.

As an intellectual exercise, let’s assume that physical cash is banned or discounted; an increasingly realistic condition. The question then becomes what if the nominal risk-free interest rate curve in the whole DM world is perceived as perpetually negative?

First, it doesn’t mean that all lending has to be at zero or negative rates. To be sure, risky borrowers may still have to pay positive rates.

However, the whole securities market dynamic may shift in a dramatic manner. Imagine when ZERO YIELD becomes the objective of financial engineering.

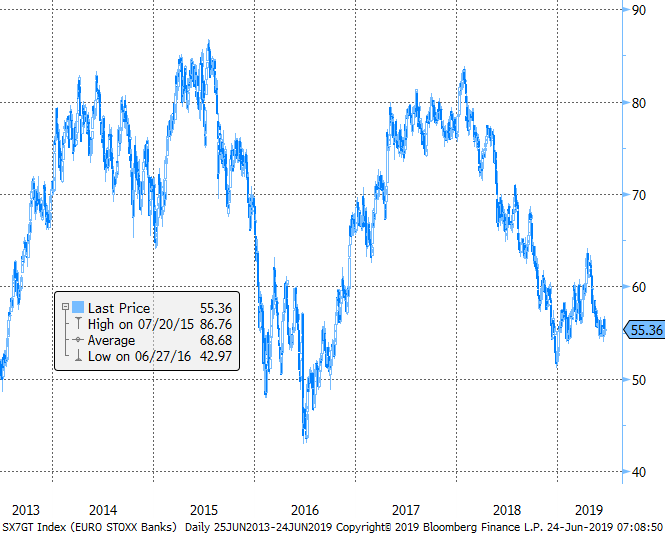

There is a common perception that zero and negative rates hurt banks in particular. Indeed, European banks, especially Deutsche bank, have been on the ropes as depicted in Figure 1.

Figure 1: Euro STOXX Banks Index (SX7GT)

However, the US banks have weathered several years of zero rates quite well, and the recent acceleration of their performance can be as much attributed to political changes and tax breaks than to the slight rise in the rates. Figure 2, below, depicts the Financial Select Sector SPDR ETF, XLF, over the same period.

I suspect that

this difference in performance is structural rather than driven by rate

differentials. Should the banks stay creative, who is better to create zero

yield instruments? In other words, in the negative rates environment the

biggest problem is storage of your cash and assets; therefore, shouldn’t the

banks, which are in the business of such storage, benefit?

Figure 2: XLF, Financial Select SPDR ETF

Without diving into an analysis of banks’ balance sheets, let’s shift to the stock market in general. There are many debates out there regarding the impact of interest rates on equity prices. Not being an expert on stock valuations, I will only discuss this at a qualitative level.

There are two commonly observed ways in which lower rates help stocks:

- Companies pay less to fund operations, or

- Corporate shares become a more attractive investment relative to bonds

There is an additional approach to looking at the second aspect, which has been recently coming to light. With negative yields, it is cheaper for investors to borrow money to buy stocks. The primary manifestation of this paradigm is corporate share buybacks. Indeed, if a corporation can consistently issue debt at a lower rate than its conservatively estimated earnings yield, why wouldn’t it drive its EPS by funding buybacks through debt?

Granted, there are reasons why not, such as the perils of over-leverage, but this is a matter of measure and prudence even if the principle still works.

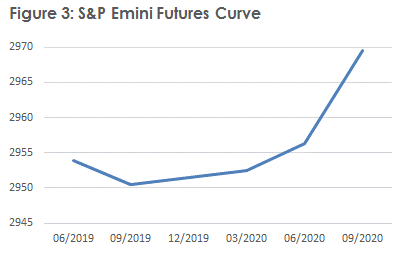

Another way to look at borrowing to buy stock is speculators buying equity futures. Assuming the margin of 4% on S&P 500 futures contracts, a speculator can synthetically borrow up to 96% to own the index. Current interest rates in the USA are slightly higher than the dividend yield, so the S&P is trading in a very slight contango as seen in Figure 3, below. That is, you have to pay a slight premium to buy deferred contracts. In other words, if you are holding futures for a long time and the level of the index doesn’t move at all, you are slowly losing money.

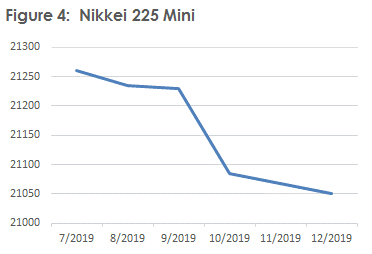

Compare this, however, with other markets like the Nikkei in Japan where the synthetic funding rate is negative. The futures are trading in consistent backwardation as can be seen in Figure 4, below. That is, you are being paid to hold your contracts, not only because of the dividends you collect, but also because of an additional “benefit” of having to borrow. Sure, short-term market swings can dwarf your immediate carry, but over the long run such accumulated benefit can become a powerful force for a speculator.

Taking this thinking to an extreme, an investor may line up to buy shares in any company which has a long-term perspective of non-negative earnings, regardless of how high the valuation is. Theoretically, any perpetually non-losing money concern becomes of infinite value.

There is an important distinction here between money one gives to a corporation in exchange for equity via a primary or secondary offering and money one gives to another investor for a share of this company.

In the environment of negative-perpetuity driving equity demand, will companies keep accepting cash until they are no longer profitable? When their capital is overwhelming, regardless of their original business, they are bound to become asset managers and be stuck with negative yield choices.

Will the incentives continue to point this way? The current shareholders will benefit more from the stock trading higher and higher in the secondary market.

Suppose you IPO a hot dog stand in New York City, which occupies a good corner, and has been netting a steady $10,000 for the last 80 years, paying it out to investors. Without taking any new capital to manage the stand, what kind of multiple of the book value can you get for it?

Practically, in such a world, all corporations will have to be priced with an assumption that at some point in the future they’ll start losing money or liquidate at a loss relative to current valuation. Such perception is very distant yet, as we view our successful corporations not only as indefinitely profitable, but also for having a potential for growth.

This brings us to the conundrum befuddling many market players nowadays: how can the stock market keep making new highs with a real economic cycle that is very likely rolling over (so likely, in fact, that multiple rate cuts are being priced in). How can companies with deeply negative earnings keep rolling out their IPOs?

Now, imagine the global financial system preparing for the onslaught of perpetually negative rates. Any stock with forward-looking positive P/E ratio, no matter how high, becomes a steal. Potentially, the whole market could double from here. Why not 10-tuple or 100-tuple?

Normally, such a bullish perspective on equities would very positive for the economy as the wealth effect would increase spending and investment. But, remember: in the world of perpetual negative rates, there is no such thing as productive investment!

In fact, the more wealth we have in the system the more it has to be invested in losing propositions, potentially spurring contraction rather than growth.

I am not an economist. I am painting this picture as an intellectual exercise as mentioned at the start, rather than putting forward a sound academic theory. Nor am I critiquing the policy, there a lot of pros and cons, and the central bankers’ job is never easy.

However, a weird conception of perpetually stagnant growth and perpetually soaring asset prices has been forming in my mind and appears not to be far from reality.

For the

record, I don’t think that this has to be our fate. It is likely the cyclical

forces will swing assets lower in the shorter run. Meanwhile, the combination

of technological progress and political evolution will lead to resurgence of

both inflation and real growth.

The argument I put forward here is designed to understand the secular trend. However, we should be cautioned that arguments of “why the stock market can go up forever” always look most convincing at the top.

Good luck,