I prefer to focus on what the Federal Reserve WILL do, instead of what it SHOULD do. A lot of time is spent debating the latter, while what will make money for us, is understanding the former.

This post is designed to communicate some ideas about trading U.S. markets in the tightening and pre-tightening environments – something the younger traders might have not experienced. But first I want to make a case why Fed’s raising rates this year is a likely scenario.

The opinions on what is necessary for the economics are clearly divided. And I am not the one to resolve this debate.

The projection of rates going up sometime in the middle of 2015 dates all the way back to 2013. Since then the market gyrated, but continued to inexorably creep to this target date. September-2016 Eurodollar contract is good proxy for the tightening schedule anticipation:

While this contract has being going nowhere, the 2-yr swap rate, which indicates where we are on this consistent schedule, is steadily creeping up:

The Fed knows this. And they are not speaking otherwise. I think they are OK with this schedule. Low inflation and strong dollar notwithstanding.

Let me be clear. I do not propose betting heavily on the tightening, especially on a particular schedule. There are a lot of uncertainties in the world – a lot can go wrong in the next few months and deter the Fed.

My point is that the current course is set and the burden of proof is on the contrarians. In this context last Friday’s job report is especially important. Usually, I don’t put much weight on a single economic indicator, but this strong release came at a critical juncture. It took away a major opportunity for the Fed to diverge from expectations by claiming weaker economy or job market.

I think we should brace for the tightening to come and enjoy the ride.

Here are some lessons I have learned from the last two tightening cycles:

1. Yield curve flattening will start earlier than you think and will be more vicious than you think.

UNDER NO CIRCUMSTANCES EXPECT HAWKISH FED TO CAUSE LONG END TO SELL OFF.

This understanding allowed me to load up on the bonds in the end of 2013 (not as an allocation, but as a leveraged trade). If the Fed stood pat, I would be receiving the carry indefinitely, but when they started leaning towards hiking – I knew the long end would be supported.

2. No matter how much the curve flattens or inverts, the reality will be even more extreme than its anticipation.

In 2006, someone told me that the easing of a cycle takes place on average only 9 MONTHS after the last tightening of the previous cycle. This sounded like complete nonsense. How stupid the Fed should be to tighten only to have to ease nine months later?

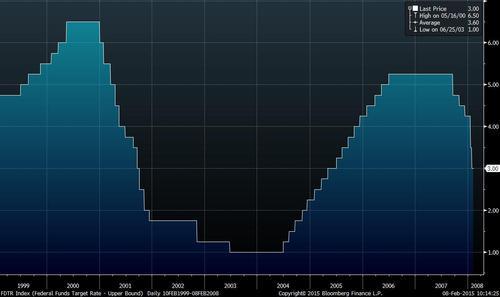

Well, let’s remember the hikes of May 2000 and June 2006. I don’t have to tell you what happened shortly after. Notice how short the “flat tops” of the Fed Funds target rate were.

So remember:

TIGHTENING LEADS TO EASING AND THE MARKETS WILL ANTICIPATE THIS TO AN EXTENT.

3. There is a lot of talk of how long (albeit lackluster) this expansion has been and for long we were in the equities’ bull market.

Well all this time we did not have hikes. The last two times:

TIGHTENING WAS FOLLOWED BY RECESSIONS.

So anticipate the stock market and the economy to roll over 2-3 years from the beginning of the tightening cycle. Given the unique current circumstances (dollar appreciation, China slowdown, European woes) those things might happen sooner.

So check the lines securing your portfolio. These are different seas.