Trumponomics

For

over two solid weeks after the election, the markets have been relentlessly

pricing in the success of “Trumponomics.”

To be clear, we mean “success” in a purely non-partisan manner. It just means the President-Elect would accomplish what he says he is going to

accomplish, whether that might be good or bad in an individual’s view.

Furthermore, we discuss economic causality only to the extent it affects

financial markets, or more precisely, how it defines superiority and dominance

relationships between specific trades.

With

that in mind, let’s start untangling Trumponomics with its flagship item:

infrastructure stimulus. Long on the Democrats’ agenda, the package of $500bln

to $1tln is now expected to pass through the Republican Congress. Without

offering our amateur political analysis, we point out that this may or may not

happen.

By

“expected,” we mean the price action in:

- Equities;

- Industrial commodities; and

- Inflation break-evens.

Surely,

if the stimulus were to pass, all else being equal, it would provide a tailwind to all of the above. But, the

magnitude of the move thus far has already been substantial enough to make us

question if betting against the stimulus is taking on a characteristic of an “Even If” trade discussed in Chapter 13 of The

Next Perfect Trade. The argument being that there are occasions when the

market pricing is so skewed towards one outcome, that betting on the opposite

outcome may make money even if

the most expected event comes to pass.

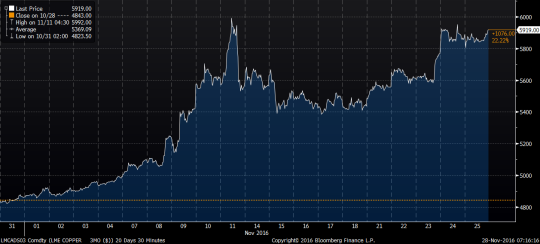

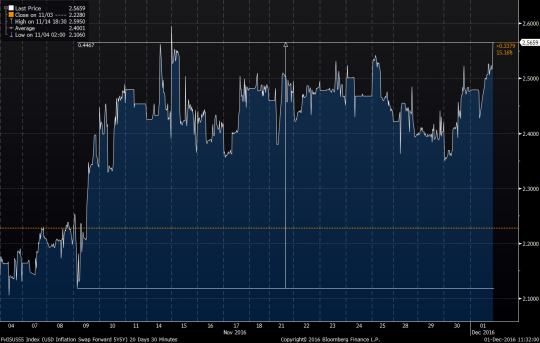

The

recent price action in pertinent markets:

US Equities: 1m Historical

Copper:

1m Historical

5Year US Inflation Breakeven: 1m

Historical

FED

Response

Now

let’s shift the discussion to the Federal Reserve. Should the stimulus pass,

the Fed would consider the rising inflation expectations justified, based on

the triple impact of:

- Rising commodity prices;

- Tightening labor markets; and

- Wealth effect from the stock market.

Importantly,

the Fed was well on track to tighten imminently regardless of the election

outcome, so in this case the EVEN IF trade points us in the direction aligned

with Trumponomics. There have been debates on whether the current Federal

Reserve is too tight or too easy. We elected to stay on the sidelines but

consistently highlighted that the Fed is indubitably hawkish relative to other DM central banks.

Though

Trump criticized Yellen during the campaign, we are not sure how much of that

was purely political rhetoric, and what he would rather she do or not do. What

we know is that Ms. Yellen is likely to stay on for the remainder of her term

and to pursue her policy framework. As for what

comes after, we would posit that the President-Elect has a good understanding

of debt and interest rates; he would likely “push” for a policy that would

neither stifle the economy through excessive hikes nor allow inflation

expectations to run away leading to a catastrophic steepening of the borrowing

curve.

We

pointed to the limitations of the curve shape as a leading indicator in our

post, Flat

Curves & Recessions, from September 28th, but steepening is

often viewed as a good thing as it is associated with periods of solid economic

growth. On the other hand, as the United

States has a considerable current account deficit, higher rates are net

negative for the wealth of the nation (more interest going to foreigners), and

this is something Trump may be aware of.

Overall,

we see no reason for the new administration to nudge the Fed to one extreme or

another, so ‘business as usual’ is our best guess.

What Does This Mean for The

dollar?

The

US dollar (USD) has strengthened a lot on the back of Trumponomics. This price

action is consistent with the notion of a

reasonably vigilant Fed, which would raise REAL interest rates in response to

higher inflation expectations.

USD: 1m Historical (DXY)

Recent

re-price of the markets notwithstanding; we continue to maintain that

stronger dollar is a concurrent necessity with

respect to higher interest rates. In other words, if US rates stay where

they are or move higher, the USD should continue to perform well on a total

return basis. For those who feel that the dollar rally has gone too far, we would refer to our post

from March of this year and point out that given the rates differentials,

the current 10-year forwards in EURUSD,

USDJPY, and USDCHF are 1.3150, 84.00, and 0.7500, respectively.

As

we have long noted, ECB, BOJ, and SNB do not have to ease further to weaken

their currencies; all they have to do is to hold steady and let the Fed lift

off.

Most

dollar bears base their view on the implicit necessity of the US rates playing

out much lower than currently projected. Our logic then dictates that betting

on lower rates is the dominant trade.

Let’s

Talk About the Transmission Mechanisms

Higher

rates and stronger dollar traditionally are seen as a recipe for a deflationary

slowdown.

As

an aside, we acknowledge the point of view that in a stronger final demand

environment, higher rates may, in fact,

be inflationary as they increase the production costs. We, however, stick with

the simple perspective that real rates are “the cost of money.” And if the cost rises, well then money

becomes more expensive, i.e. deflation. Of course, a further nuance may

be possible arguing that higher rates are mostly deflationary for asset prices,

not consumer goods – a theory well supported by the fact that recent low rates

have helped asset prices much more than wages.

We

are acknowledging those arguments to emphasize serious uncertainties and

complexities in the rates mechanism, but we will stick to the simple

observation that “too high rates” typically lead to a collapse in the stock market, which is often followed by an economic slowdown.

We

have long argued for the negative predictive power of interest rates and that

perpetually upward sloping and steep

yield curves, provide a tailwind for the secular bond bull market.

The

dollar rise should be even less controversial, as it incrementally leads to

weaker exports and lower imports prices.

So,

on an “all else being equal” basis, the recent shift to higher rates and stronger

dollar equates to a tightening monetary condition and should lead to lower

inflation expectations, a flatter yield curve,

and lower equity prices.

This

transmission mechanism is challenged by

the market’s acceptance of the Trumponomics. The higher rates would be offset by the stimulus and the impact to trade from a higher

dollar by import taxes. Tariffs being another “may or may not happen”

proposition. We will not even go into

the risk of a global slowdown caused by potential

trade wars.

It

is sufficient to say that the tightening of economic conditions is present here

and now, and stimulus and tariffs are

something that might happen in the future and just might have the expected

effect.

As

you may guess, we continue to argue for

our portfolio strategy; a combination of long US bonds and long US dollar

against DM currencies.

When

addressing bonds, it is important to

mention the credit risk which may increase

with Trump’s potential expansion of the budget deficit and his rhetoric,

however unlikely, regarding a “workout” on the US debt.

Long-dated bonds have cheapened significantly

over the last few days on an asset swap basis, some of them approaching the

level of Libor + 60 bps. Some have viewed that relationship as mathematically impossible

and attribute it purely to technicals related to the Dodd-Frank limitations of

balance sheet and foreign CB selling.

As

we wrote in a blog post a year ago, it is not exactly as simple as that.

However,

setting technicals aside, the only economic justification for the current levels is the pricing of at least 100bps of credit risk. This, in itself, implies something like 80

cents on the dollar workout on long-dated

bonds, which in our view is extremely conservative.

There

is no doubt that the Trump victory has introduced more uncertainty into the

rates environment, but we are well compensated

for this. For example, while we would

rather be long bonds with Clinton than with Trump at the same level, we prefer

to be long bonds with Trump for an extra 100 bps.

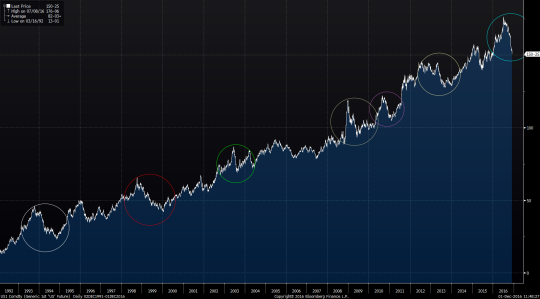

And

finally, for what it’s worth, both the magnitude and velocity of the recent

correction are entirely consistent with

multiple, recent corrections including:

Long-Bond Futures: Corrections of 1994,

‘00, ‘02, ’06, ’09, ’11, ’13, ’15, ‘16

For now,

the One Chart still rules them all.

Good

luck!