There are two common delusions about the Fed:

They know something we don’t

They are stupid

Ms. Yellen got her reputation for being a dove in the years following the Great Recession, when it was correct to be a dove. That is not an evidence of her dovishness, but rather of her intelligence.

Nowadays we are at true crossroads. I have discussed in my previous posts, how there is an abundance of solid arguments for both sides of the interest policy debate.

Fixed income analysts, allocators and traders are racking their brains to decipher the central bank rhetoric and the Hodge-podge of confusing data. They are on the sacred quest for the date of the first hike. I can hear them mumbling their prayer: “June, September, September, June, December, no June, no June, maybe September, no September…”

I am no stranger to such soul-searching. My career started with trading interest rate derivatives in the late 90’s. In fact, I used to make markets on basis swaps (the swaps between various floating rates, such as LIBOR, commercial paper, or prime). Such products required me to focus on very short-term rates.

With my recent posts, I weighed into the 2015 rates hike debate. I have been inclined to believe that the Fed was on the course to raise rates this year and the burden of proof was on the doves. But I have never had a date pinned in my mind.

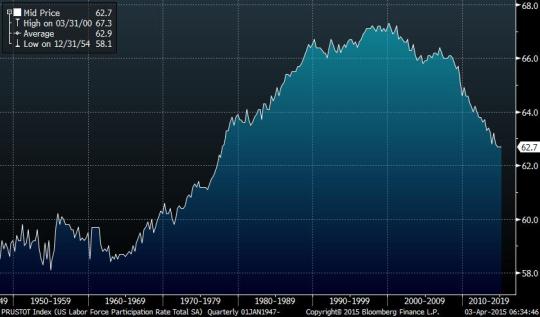

The recent unemployment report, however, was unquestionably weak. On Friday, I was one the people, whose attention was drawn to the continuing downtrend in the participation rate.

It is hard to get too excited about the falling unemployment rate, when the participation rate is only accelerating on its millennium downtrend. There are different ways to interpret this phenomena.

I think that lower participation rate reflects the trend towards labor redundancy, about which I wrote in my recent post on March 22nd. The economy needs less and less human input to march forward, so people are getting pushed out from the labor market.

Those long-term considerations combined with recent headline weakness, could by themselves shake any hawkish conviction. But even before the April 3rd release, the sentiment had been shifting towards greater uncertainty and confusion.

I am throwing in the towel. I don’t know what the Fed will do and Janet Yellen doesn’t know either. What is more important, she is not afraid to say so.

I am not a fan of the Central Bank policy of predictability and gradualism. On occasion, it felt that Greenspan and Bernanke were more compelled to hold hands of Wall Street traders than to protect the actual economy.

Indeed, financial media has a tendency to portray high volatility and low liquidity as a negative course of events. Critiques of the Quantitative Easing, for example, often point out that the program might reduce liquidity in the sovereign bond market. I could never understand it: given the huge budgetary and macroeconomic impact of the QE, are we really so worried about some traders being hurt by the bond volatility?

Many would agree with me that long period of low volatility and apparently unlimited liquidity lead to over-leveraging by risk takers.

In this case, is it not reasonable to deduce that the measured and predictable Fed was among the culprits of the recent financial crisis and the Great Depression?

My recent critique of @benbernanke on Twitter caused a surge of disagreement and debate. The general feeling was that were lucky to have him as a chairman during the crisis. My opinion is that things couldn’t have gone much worse.

Admittedly, I am biased. I got hurt badly in August 2007 by betting on the Fed responding to the freeze-up in financial markets much more vigorously. I couldn’t imagine (and still can’t) that Bernanke’s response to the unfolding catastrophe would be slow slow and lackluster.

Do you see LIBOR going up in August and September? Do you see that the Fed barely managed to get it down by the end of the year?

I see this as egregious a failure, as Greenspan’s infamous 50bps hike in May 2000 in the middle of the unfolding collapse of the internet bubble.

Am I now asking the Fed for a bailout? No, the Central Bank has no obligation to bail out my portfolio. There shouldn’t be too concerned if their actions blow up a few traders and help disproportionately a few others.

But when a systemic crisis unfolds, it is beneficial for the Fed to move with decisiveness of Alexander the Great and not to worry about timely signaling and methodical approach.

This is the problem with academics running the Fed: there are afraid to be wrong and act prematurely, so they collect the preponderance of evidence before acting. Traders have no such compunctions.

You see the financial system freeze? Cut right away, don’t talk, just cut! You find out your actions were excessive: tighten back. Nobody was ever able to explain to me what was wrong with the Fed being dynamic and flexible.

I hope that Ms. Yellen will bring us a more dynamic Fed and a higher interest rate volatility. Instead of the Fed pushing forward on a preset course with bull-headed certainty, I’d rather have a factitious collection of central bankers as confused and befuddled, as the rest of us, by the conflicting stories.

Let’s allow the possibility that the Fed knows about the dollar, the unemployment, the globalization, the U3, the U6, the commodity prices, and even the economic singularity. And they don’t know either what the should do or what they will do.

I don’t claim to be a better economist than Ben Bernanke. In fact, I respect his intelligence and scholarship greatly. Now that he has started blogging, I think he is on a short-list to be the most influential financial blogger in the world.

The same is true about Janet Yellen: I am sure she knows everything I do and more about the economy and inflation.

What I am trying to be, is a better trader. So let’s trade circles around the Central Bank.

With intelligent, but unpredictable Fed, and complex economic story, is it really worth committing our capital to pinpoint the “lift-off” date for the rate cycle?

My strategy over the last couple of years was consistent with remaining agnostic about the first hike. I have summarized it in a tweet last year:

Long bonds are perfect:

- Fed hikes – they rally.

- Fed holds – they carry.

So I will stay the course and keep away from bets on the short end of the yield curve.

I am also staying long dollar, because I think the dollar will benefit whenever the hiking cycle will start, and especially so, if the rates will go up much more than I expect.

This is how I hope to circumvent Yellen’s dilemma and survive whatever course she takes.

dove-object-black2 Image by David Campbell