Today’s market participants are thoroughly puzzled by the recently

renewed inversion of swap spreads; in

other words, by the fact that the yield on the long-dated US Treasury notes and

bonds is higher than the corresponding interbank swap rate for the same

maturities.

US 10yr Swap Spreads over

past 5yrs

Several portfolio managers, financial journalists and market

spectators are calling this inversion completely

illogical, and even mathematically impossible.

And usually they site this as evidence of a broken financial system.

Indeed, it seems to make little sense that

the swap curve which is based on LIBOR (London Interbank Offered Rate) would

reflect a lower lending rate than the full faith and credit of the US

Government.

From a market perspective, those who follow me know that I am big

fan of US bonds and that I think they are currently cheap on both an absolute

basis as well as relative to swaps. But

in the interest of intellectual honesty, I must concede that the inversion of

swap spreads is NOT mathematically meaningless.

Allow me to share an observation I made in my very early days

after entering the swap market in 1997.

The popular “swap spread” is not a

spread between apples and apples.

In fact, the spread

compares two completely different types of financial instruments.

- A bond, which is an asset, is a security which represents

term lending of cash to the government and includes all associated risks. - A swap, which is a derivative as opposed to an asset,

represents a bet on a string of three- month interbank lending rates which

includes no principal risk.

In other words, the swap spread does not compare ‘term lending

to the government’ with ‘term inter-bank lending’. If you doubt it, see

where a bank can borrow money for ten years – I can assure you the rate would be higher than that of a ten year US Treasury.

So, we are comparing term lending to the government with a

projection of a rolling short-term interbank lending rate. And if the interbank

market breaks down, the payers of Libor will be nailed for a period of days, quarters,

etc, but will not risk the whole principal investment like the bond holders.

Importantly, the way to

think of the inversion of the swap spreads is not a mathematical break-down,

but rather a spike in the term premium. The

situation we are witnessing today is not new to debt-laden, developed

countries, such as Japan.

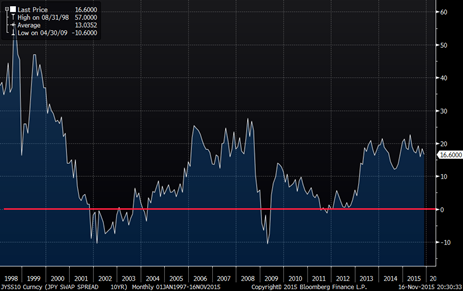

Japanese 10yr Swap Spreads

Since 1998

That said, we can still perform a “carry” or

“terminal value” analysis of the trade of being long bonds vs. paying

interest rate swaps, similar to the examples I discussed in Chapters Two and

Three in my book The

Next Perfect Trade.

Mathematically, we are comparing three month LIBOR with the

rolling funding rate for Treasuries; the rate at which you can borrow money if

you offer your bonds as collateral. Note: in the unlikely event of imminent

default, the funding rate will go to virtually infinity.

While most of us are not actually afraid of a US default, we

cannot secure the funding rate that would guarantee arbitrage profits.

Banks can likely secure the funding, but they are limited in their ability to

take additional market risk or expand their balance sheets.

In summary, the swap spread inversion is not mathematically

impossible and does not indicate a collapse of the financial system. And, betting on its normalization is a good,

but not riskless trade.

Image: Apples to apples to apples by Artful Magpie