All too often I hear sentences like “The bond market and the stock market say opposite things about the economy” or “A flat curve means recession, so if you expect the curve to get flatter that means you are expecting an imminent recession”.

The purposes of this post are to dig a little deeper into the concepts of concurrencies and causality associated with the yield curve and to challenge some of the common assumptions embedded in the statements above.

While the “Freakonomics” crowd loves debunking confusion between correlation and causality, I will instead write in terms of the distinction between “causes” and “indicators” and, furthermore, between “leading” and “concurrent” indicators.

My strategy mostly deals with causes. In my book, I discuss how causal relationships between two market events can be characterized in terms of necessity and concurrency and how to trade based on such characterization.

By way of example, the Fed moving to tighter monetary policy has a clear causality relationship with a stronger dollar and a flatter US yield curve. As always, some would disagree even with this paradigm. But I am comfortable with this causality being if not as “certainty”, but an at least a “certain likelihood”.

In my book, I have demonstrated how, in 2014, the stronger dollar was a concurrent necessity with respect to rising rates and thus a dominant trade. That meant by the time the Fed tightened, dollar would have to have strengthened but it might have (and did!) strengthened even without the tightening.

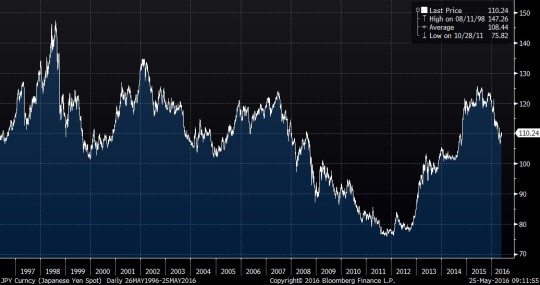

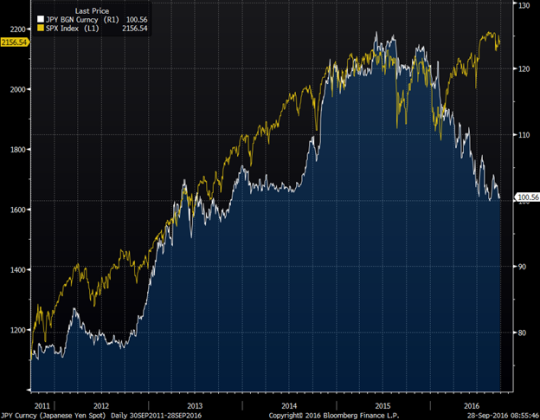

There are, however, highly correlated pairs of market events with a more obscure causality relationship. For example, up until 2016, USDJPY traded in high correlation with all risk assets, including not only the Nikkei but also the S&P 500. In my post, The Tale of Three Shorts, I have discussed some of the complexity there and even suggested that strong JPY trade may be a self-defeating chicken (a thesis yet to be verified). To put in simply, the correlation was obvious to me, but the causality wasn’t.

In such situations, I refer to events as “indicators” rather than “causes”. I have several times heard sentences like “weaker USDJPY spells trouble for stocks”. Such statements irked me as logically flawed, but the fallacy is not immediately obvious. Indeed, stocks tend to go down when JPY strengthens, don’t they?

This is where I introduce the notion of the concurrent indicator. If I look at my screen and see USDJPY up on the day and don’t look at anything else – what is my guess about the stock market? Of course, it’s more likely that the stocks are up. But why shouldn’t I look at anything else? I have a full screen of prices available.

My point is that USDJPY doesn’t convey any information about equities that I can’t see by looking at the equity screens. Yes, usually when USDJPY falls, S&P 500 trades lower as well, but if it did not go down there is no obvious ECONOMIC causality saying that it has to catch up. So, as I see it there is little predictive power to gain from divergence in this pair; what has happened, already happened. And with this mindset I was not at all shocked with the divergence of this year.

5Yr Chart of USDJPY (White) vs SPX (Yellow)

But what about the clearly statistically confirmed “leading” indicators? My contention here is that even those may not convey as much useful information as appears.

As you can guess, I am taking a swipe at the maxim that flat yield curves forecast recessions and steep yield curves forecast robust economic growth, which appears to be accepted by market participants almost without question.

The evidence is undoubtedly strong – flat curves indeed preceded all the recent recessions. But my question is, “does the curve convey any information about the possibility of a recession, we don’t have otherwise?”

Imagine that you have jumped from the roof of a high-rise. Falling past the 10th floor is a very reliable indicator of soon hitting the ground, but what new information does it contain? Given that you jumped off consciously and are familiar with the law of gravity – none.

What if you fell while sleeping? Well, waking up to see the 10th-floor flash by is definitely good info. But returning the analogy to macro-trading, my assumption is that you are not asleep.

Then what if the law of gravity changes? In this case, the 10th floor may not even be a reliable leading indicator anymore.

Over the last few decades, we got used to certain patterns of the business/rates cycle. Events were happening in a certain order and over certain predictable time intervals:

1. Rapid economic growth

2. Tight labor market and inflationary pressure

3. Rising rates

4. Yield curve flattening

5. Hiking cycle

6. Bear stock market

7. Rates fall

8. Growth slows down

9. Easing cycle

10. Curve steepens

11. Stock market rebounds

12. Rapid economic growth

Notice, any of the events in this loop could be used as reliable leading indicators for any subsequent events. Assuming the loop persists.

As I have discussed in Chapter 4 of my book, historical patterns are important to study because they are more likely to repeat than not. But if we make an a priori assumption that this loop will just keep going on without alteration – we almost wouldn’t need to observe anything else – we would already know what happens next.

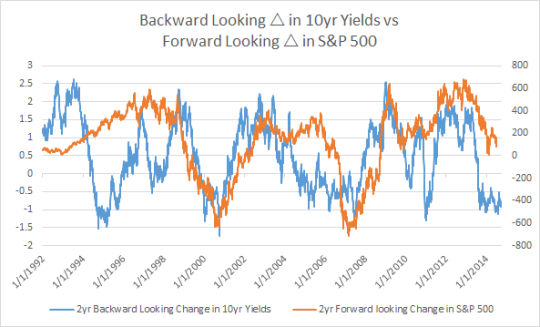

In that chapter, I gave an example of using interest rate momentum as a predictor of future stock market price action. That is, I showed a decent fit between the two-year backward looking change in the 10-year note yield and the two-year forward-looking change in S&P 500. In the loop above it would mean bullet point 7 (rates fall) is a leading indicator of 11 (stock market rebounds).

Backward-Looking Change in 10yr Yields vs Forward-Looking Change in S&P500

Why is there good information in this pattern? My claim is that the information is there because there is CAUSALITY. Lower funding rates lead to improved corporate profits. And this simple paradigm lends extra strength to my pattern argument.

When, however, people make the assumption that 4 (yield curve flattening) predicts 8 (economic slowdown), their assumptions are not backed up by direct causality. This does not imply the indicator is wrong, but rather it makes it more fragile.

In the past decades, 4 (yield curve flattening) was typically associated with 5 (hiking cycle). However, as we have approached zero rates and entered the world of QE, the laws of gravity have changed. Curves in the developed world are flattening in the LOW rate environment and they are no longer backed by the causality of the increased funding cost.

The jury is out on whether in the new environment yield curves will reliably forecast the business cycle. My contention is that they are unlikely to carry any information not already familiar to an alert macro player. For myself, I will stick to indicators resting on the simple and evident logic of causality.